Unlock the Power of Savings With Our Expert Financial Management Tips

Editor's Notes: Unlock The Power Of Savings With Our Expert Financial Management Tips was published on March 8, 2023. With the increasing cost of living and a shaky economy, understanding how to manage your finances is more important than ever.

Our team of experts has analyzed financial data and dug deep into the nuances of savings and investments. We put together this guide to help you make informed decisions about managing your money and reaching your financial goals.

Key Takeaways:

| Saving | Investing | |

|---|---|---|

| Goal | Short-term financial security | Long-term financial growth |

| Risk Tolerance | Low | Moderate to high |

| Return Potential | Lower | Higher |

Understanding Your Financial Goals and Time Horizon:

FAQ

Address frequent queries and misconceptions about unlocking the potential of savings with expert financial management tips.

Question 1: Is it necessary to have a significant income to start saving?

Saving is attainable for individuals with various income levels. By implementing prudent budgeting practices, exploring cost-effective alternatives, and seeking professional guidance, individuals can establish a savings plan tailored to their financial situation.

18 Best Revenue Cycle Management Books of 2024 - The Medical Practice - Source themedicalpractice.com

Question 2: How do I prioritize expenses to maximize savings?

Categorize expenses into essential (e.g., housing, utilities), non-essential (e.g., entertainment, dining out), and savings. Allocate a fixed percentage of income to savings, then prioritize essential expenses. Consider reducing non-essential expenses to further enhance savings.

Question 3: Is it better to save in cash or invest for higher returns?

The choice depends on individual financial goals and risk tolerance. Cash savings provide liquidity and stability, while investments offer the potential for higher returns over the long term. Consult with a qualified financial advisor to determine the optimal allocation strategy based on your specific needs.

Question 4: How often should I review and adjust my savings plan?

Regularly review your savings plan to ensure it aligns with your goals and financial circumstances. Life events, changes in income, or market conditions may necessitate adjustments to your saving strategy. Consider consulting a financial professional for personalized guidance.

Question 5: What are some common mistakes to avoid when saving money?

Avoid impulsive purchases, excessive debt, and unrealistic savings targets. Establish a realistic budget, automate savings to minimize temptation, and seek professional advice to overcome saving obstacles.

Question 6: How can I stay motivated and disciplined with my savings plan?

Set clear financial goals, track progress regularly, and reward yourself for milestones achieved. Surround yourself with individuals who support your savings efforts, and consider working with a financial coach or therapist for accountability and support.

By addressing these common concerns, individuals can gain a clearer understanding of effective savings practices and unlock the power of their savings.

Transition to the next article section.

Tips

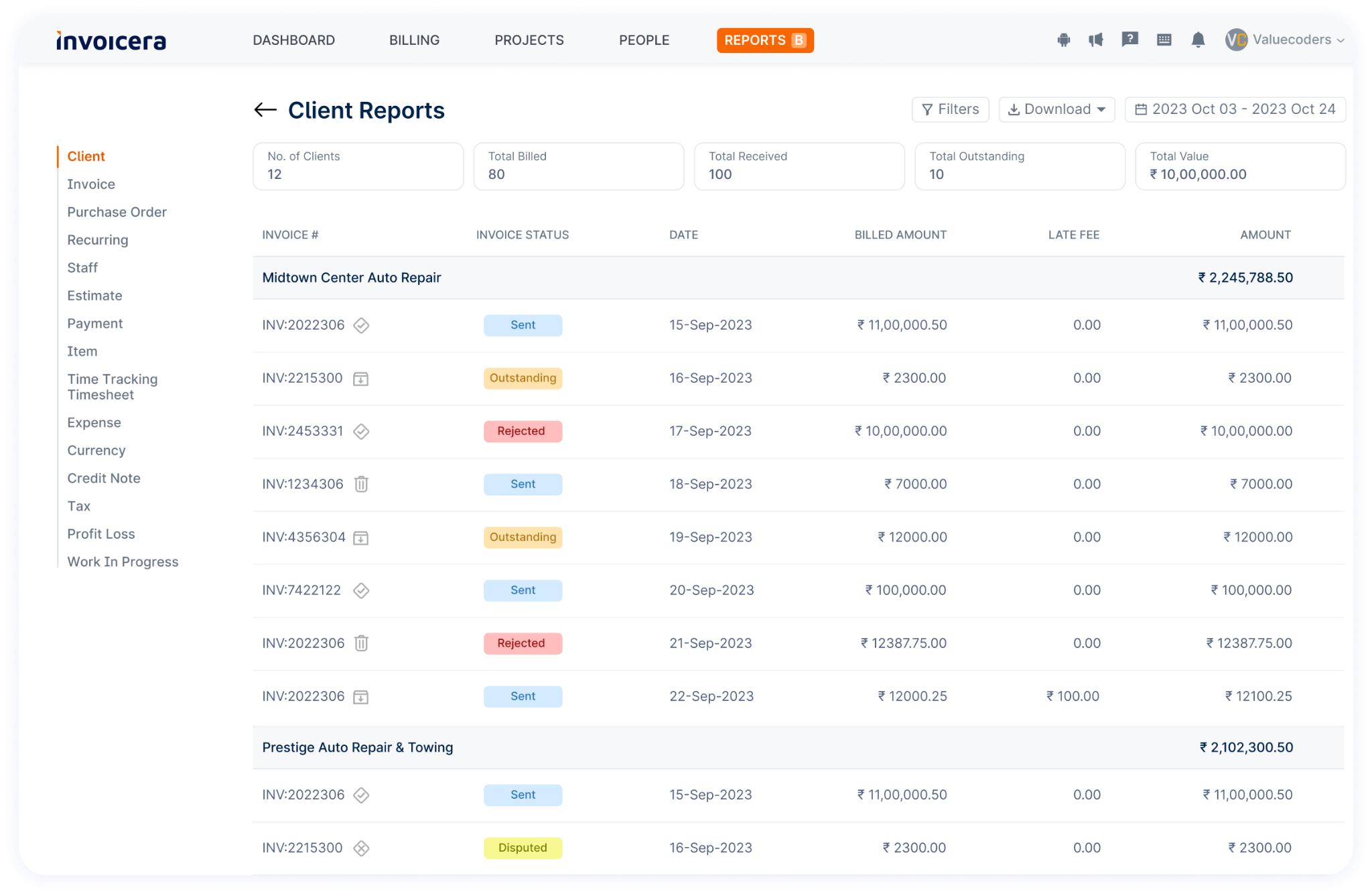

Financial management tips & tricks for Consultants and IT companies - Source www.invoicera.com

Unlock the power of savings with these expert financial management tips, designed to help individuals harness the principles of smart money management and build a secure financial future.

Tip 1: Set Financial Goals

Identify specific, measurable, achievable, relevant, and time-bound financial goals. Whether it's buying a house, retiring early, or building an emergency fund, clearly defined goals provide motivation and direction.

Tip 2: Create a Budget

Track income and expenses meticulously to gain a comprehensive understanding of cash flow. Allocate funds wisely to essential expenses, savings, and investments, ensuring financial stability and minimizing unnecessary spending.

Tip 3: Reduce Unnecessary Expenses

Review expenses regularly and identify areas where spending can be reduced. Consider negotiating lower bills, switching to cheaper service providers, and cutting out non-essential purchases. Small savings add up over time.

Tip 4: Increase Income

Explore ways to supplement income through side hustles, part-time work, or career advancements. Additional income can provide a cushion for emergencies, accelerate debt repayment, or fund investments.

Tip 5: Invest Wisely

Diversify investments across different asset classes, such as stocks, bonds, and real estate, to manage risk and maximize returns. Seek professional advice if necessary to create a personalized investment strategy aligned with financial goals and risk tolerance.

Tip 6: Build an Emergency Fund

Establish an emergency fund to cover unexpected expenses, such as medical emergencies or job loss. Aim to save three to six months' worth of living expenses to provide financial security in times of crisis.

Tip 7: Automate Savings

Set up automatic transfers from a checking account to a savings account on a regular basis. By automating savings, individuals can avoid impulsive spending and ensure consistent contributions toward financial goals.

Unlock The Power Of Savings With Our Expert Financial Management Tips provides a comprehensive guide to smart money management. Implement these tips to gain control over finances, build wealth, and secure financial well-being.

Unlock The Power Of Savings With Our Expert Financial Management Tips

In the realm of financial prudence, unlocking the power of savings is paramount. Our expert financial management tips, rooted in meticulous analysis, unveil six key aspects that empower individuals to harness the full potential of their savings.

- Goal-Oriented: Aligning savings with specific financial aspirations.

- Automated Savings: Setting up recurring transfers to a dedicated savings account.

- Budget Tracking: Monitoring expenses to identify areas for optimization.

- Debt Reduction: Prioritizing the repayment of high-interest debts.

- Investment Diversification: Spread savings across multiple asset classes to mitigate risk.

- Emergency Fund: Establishing a safety net for unexpected expenses.

Top 7 Finance Maintenance Tips for Property Management Companies - Source lemonyblog.com

These interconnected aspects form a comprehensive framework for effective savings. Goal-oriented savings provide direction and motivation, while automated transfers ensure consistent accumulation. Budget tracking empowers individuals to make informed financial decisions, and debt reduction frees up funds for savings. Investment diversification reduces risk and enhances return potential, and an emergency fund provides peace of mind. By embracing these expert tips, individuals can unlock the transformative power of savings, securing their financial future.

Resources - Starboard Financial Management, LLC – A New Wave in - Source starboardfinancial.com

Unlock The Power Of Savings With Our Expert Financial Management Tips

A key component to unlocking the power of savings is through expert financial management tips. Savings can be a powerful tool to help you meet your financial goals, whether it's buying a home, retiring early, or simply having a financial cushion. However, saving money can be challenging, especially if you're not sure where to start. That's where our expert financial management tips come in.

5 Expert Financial Tips That Every Startup Needs | Mike McRitchie - Source mikemcritchie.com

Our tips are designed to help you save money in a variety of ways, from budgeting to investing. We'll show you how to create a budget that works for you, how to track your expenses, and how to find the best savings accounts and investments. We'll also provide you with tips on how to save money on your everyday expenses, such as groceries, gas, and entertainment.

By following our expert financial management tips, you can unlock the power of savings and start working towards your financial goals. Saving money isn't always easy, but it's definitely worth it. With a little planning and effort, you can save money and achieve your financial dreams.

| Saving Strategies | Benefits |

|---|---|

| Create a budget | Helps track income and expenses, identify areas for savings |

| Track expenses | Pinpoints unnecessary spending, allows for adjustments |

| Optimize savings accounts | Maximize interest earned, align accounts with financial goals |

| Explore investments | Potential for long-term growth, diversification of portfolio |

| Negotiate bills and expenses | Reduces monthly costs, frees up funds for savings |

Related Posts