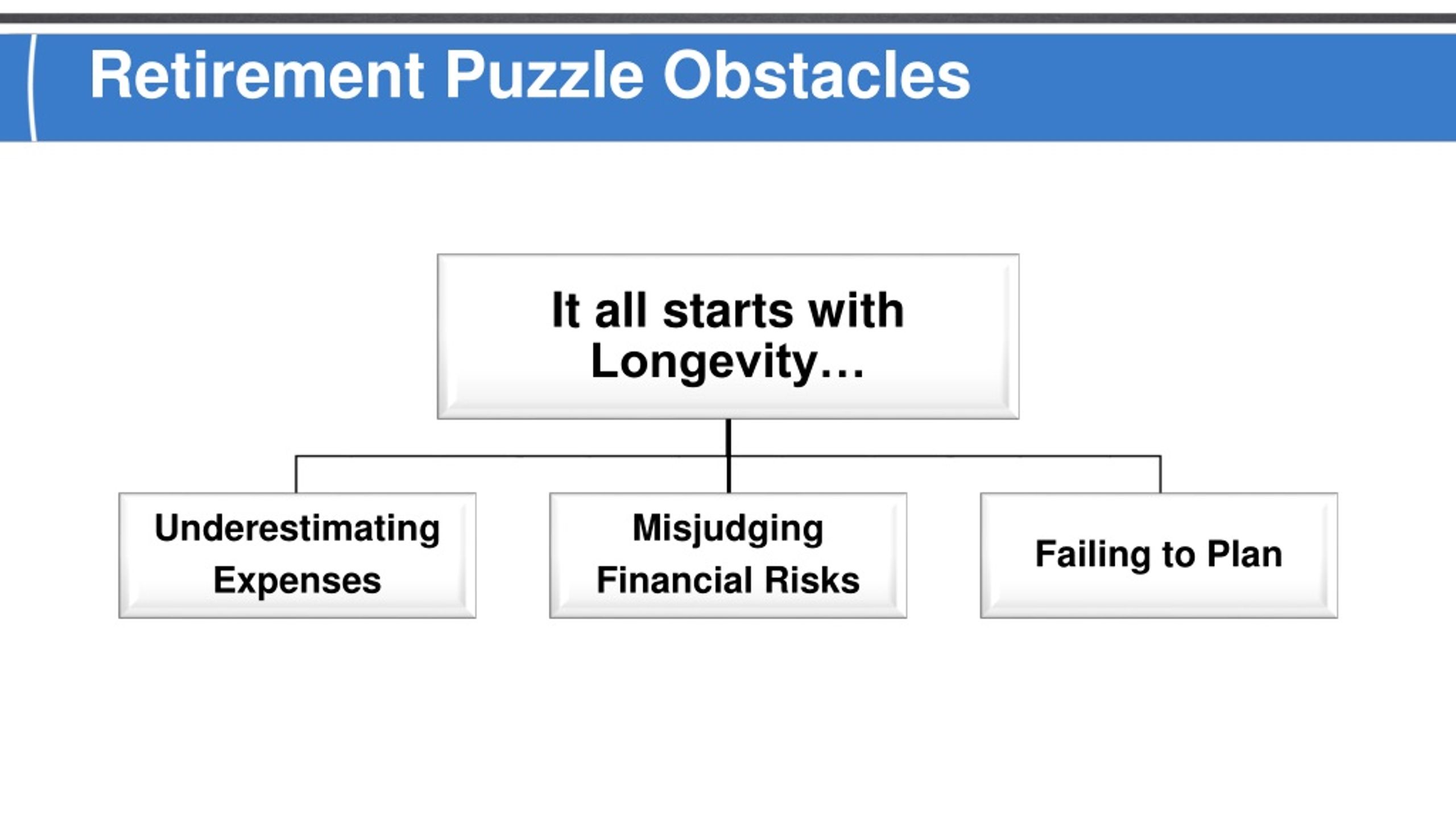

Do you know what are the Obstacles In Retirement For Social Security Beneficiaries? If you have Social Security retirement benefits, you may encounter several obstacles while planning for a comfortable retirement. These challenges can affect your financial security and overall well-being during your golden years.

Editor's Notes: "Obstacles In Retirement For Social Security Beneficiaries" have published today, 14th April 2023. This topic is imperative to those who want to have a comfortable retirement life, especially for those who rely on Social Security benefits.

After analyzing and digging into a lot of information, we were able to put together this guide to help you understand the potential obstacles you may face and provide strategies to overcome them. Let’s dive into the key challenges and explore practical solutions to help you plan for a secure retirement.

Social Security benefits are calculated based on your lifetime earnings, so individuals with lower incomes may receive lower benefits. Additionally, Social Security benefits are subject to taxation, which can further reduce your income during retirement.

| Key Differences | Key Takeaways |

|---|---|

|

Insufficient savings and retirement planning. |

Start saving early and invest wisely to supplement your Social Security benefits. |

|

Rising healthcare costs. |

Explore affordable healthcare options, such as Medicare Advantage plans or long-term care insurance. |

|

Inflation eroding the value of benefits. |

Consider investments that outpace inflation, such as stocks or inflation-linked bonds. |

|

Longer life expectancy leading to more years in retirement. |

Plan for a longer retirement period by increasing your savings and considering part-time work. |

|

Access to affordable housing and transportation. |

Explore government assistance programs, community resources, and downsizing options to manage housing costs. |

Nine Charts about the Future of Retirement | Urban Institute - Source www.urban.org

While Social Security provides a financial foundation for many retirees, it's essential to plan ahead and address these potential obstacles to ensure a comfortable retirement. By understanding the challenges and implementing proactive strategies, you can increase your financial security and enjoy a fulfilling retirement.

FAQ

Social Security benefits are an essential source of income for many retirees. However, there are a number of potential obstacles that can affect the size of these benefits, including age, earnings, and other factors. The following are some frequently asked questions about obstacles to Social Security benefits:

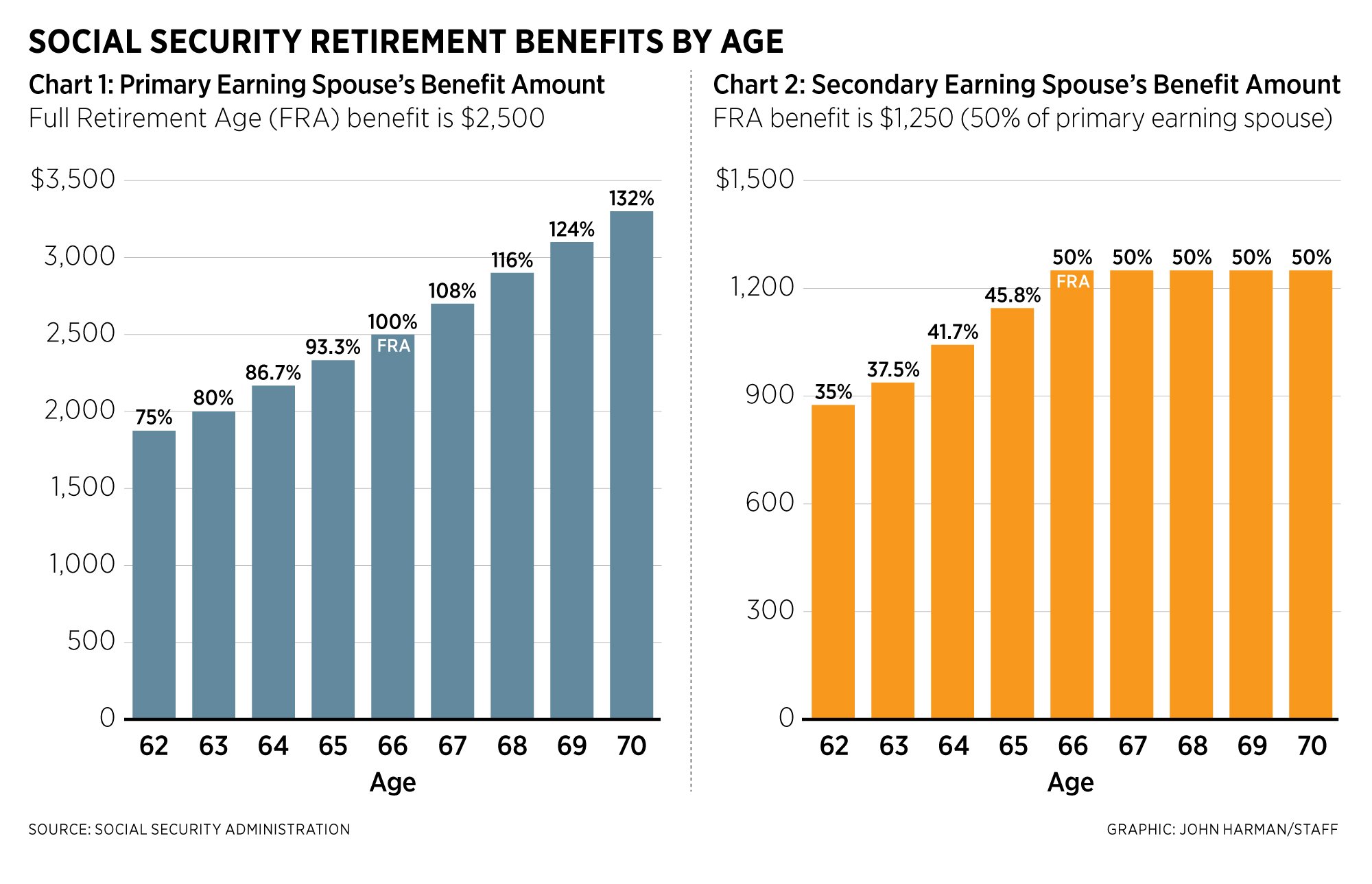

What You Should Know About Social Security Retirement Benefits - Source www.youngmarrlaw.com

Question 1: What is the earliest age I can claim Social Security retirement benefits?

Answer: The earliest age you can claim Social Security retirement benefits is 62. However, if you claim benefits before full retirement age, your benefits will be reduced.

Question 2: I have not worked long enough to qualify for Social Security retirement benefits. Can I still receive benefits?

Answer: If you have not worked long enough to qualify for Social Security retirement benefits, you may be able to receive benefits based on your spouse's earnings record.

Question 3: I am receiving Social Security disability benefits. Can I also receive Social Security retirement benefits?

Answer: Yes, you can receive both Social Security disability benefits and Social Security retirement benefits. However, your disability benefits will be reduced once you reach full retirement age.

Question 4: I am a high earner. Will my Social Security benefits be taxed?

Answer: Yes, Social Security benefits are taxed if your combined income from all sources exceeds a certain amount.

Question 5: I am married. Can my spouse receive Social Security benefits based on my earnings record?

Answer: Yes, your spouse may be able to receive Social Security benefits based on your earnings record if they meet certain requirements.

Question 6: I am divorced. Can I receive Social Security benefits based on my ex-spouse's earnings record?

Answer: Yes, you may be able to receive Social Security benefits based on your ex-spouse's earnings record if you meet certain requirements.

Social Security benefits are an important part of retirement planning. By understanding the potential obstacles to these benefits, you can make informed decisions about when to claim benefits and how to maximize your income.

Tips

When thinking about retirement and Social Security, there are common obstacles that beneficiaries face.

Tip 1: Plan for expenses beyond Social Security.

Social Security benefits often do not cover all retirement expenses. To avoid financial stress, create a budget that includes additional sources of income, such as savings, investments, or a part-time job.

Tip 2: Consider healthcare costs.

Healthcare expenses can be a significant drain on retirement savings. Explore supplemental health insurance options, such as Medicare Advantage or long-term care insurance, to manage these costs effectively.

Tip 3: Address debt before retiring.

Outstanding debts, such as credit card balances or mortgages, can hinder financial security in retirement. Prioritize debt repayment to reduce monthly expenses and increase cash flow.

Tip 4: Plan for inflation.

The cost of living tends to rise over time, eroding the purchasing power of Social Security benefits. Consider inflation-protected investments, such as Treasury Inflation-Protected Securities (TIPS), to maintain financial stability.

Tip 5: Seek professional advice.

A financial advisor or retirement counselor can provide personalized guidance on managing Social Security benefits, optimizing investments, and planning for a secure retirement.

These tips can help beneficiaries navigate common obstacles and pave the way for a comfortable and financially secure retirement. For more in-depth information, Obstacles In Retirement For Social Security Beneficiaries.

By following these tips, beneficiaries can increase their financial flexibility and enjoy a more secure retirement.

Obstacles In Retirement For Social Security Beneficiaries

Social Security benefits provide a crucial safety net for many retirees, but accessing them can be fraught with challenges. Here are six key obstacles that beneficiaries face:

- Benefit delays: Applications can be delayed due to administrative errors or missing information.

- Insufficient benefits: Rising living costs and inflation can erode the value of fixed benefits.

- Medicare premiums: Beneficiaries often have to pay a portion of their Medicare premiums from their Social Security benefits.

- Work restrictions: Beneficiaries under full retirement age may face benefit reductions if they earn above certain limits.

- Estate planning complexities: Social Security benefits may impact estate planning and inheritance strategies.

- Fraud and scams: Retirees are often targeted by scams related to Social Security benefits.

Addressing these obstacles requires a multifaceted approach, including streamlining application processes, increasing benefits to keep pace with inflation, reforming Medicare financing, and providing education and resources to beneficiaries. By overcoming these barriers, we can ensure that Social Security remains a reliable source of support for those who have worked hard and contributed throughout their lives.

MOAA - When It Comes to Social Security Retirement Benefits, Timing Matters - Source int.moaa.org

Obstacles In Retirement For Social Security Beneficiaries

Social Security is an essential retirement safety net for millions of Americans. However, many beneficiaries face obstacles that can make it difficult to make ends meet in retirement. These obstacles include:

PPT - Financial Awareness Series PowerPoint Presentation, free download - Source www.slideserve.com

- Low benefit payments: The average Social Security benefit is only about $1,500 per month, which may not be enough to cover basic expenses in retirement.

- Inflation: The cost of living increases over time, while Social Security benefits only increase by a small amount each year. This can make it difficult for beneficiaries to keep up with the rising cost of living.

- Healthcare costs: Healthcare costs are a major expense in retirement. Many Social Security beneficiaries have to pay for these costs out of pocket, which can put a strain on their finances.

- Retirement savings: Many Social Security beneficiaries do not have enough retirement savings to supplement their Social Security benefits. This can make it difficult to maintain their standard of living in retirement.

- Lack of financial literacy: Many Social Security beneficiaries do not have the financial literacy skills to make informed decisions about their retirement finances. This can lead to poor investment decisions and other financial mistakes that can further reduce their retirement income.

These are just a few of the obstacles that Social Security beneficiaries may face in retirement. It is important to be aware of these obstacles and to plan ahead for retirement. By taking steps to save for retirement, increase financial literacy, and reduce expenses, Social Security beneficiaries can increase their chances of enjoying a comfortable retirement.

While Social Security provides a valuable source of retirement income, it is important for beneficiaries to be aware of the challenges they may face in retirement. By planning ahead and taking steps to address these challenges, they can help ensure a secure and comfortable retirement.

Conclusion

Social Security is an essential part of retirement planning for millions of Americans. However, it is important to be aware of the obstacles that beneficiaries may face in retirement and to plan ahead. By taking steps to save for retirement, increase financial literacy, and reduce expenses, Social Security beneficiaries can increase their chances of enjoying a comfortable retirement.

Additionally, policymakers should consider ways to improve the Social Security system, such as increasing benefits and indexing them to inflation. These changes would help ensure that Social Security beneficiaries can maintain their standard of living in retirement.

Related Posts