Unlock the doors to insightful market knowledge with Tata Electronics share price performance and trend analysis. Dive deep into the fluctuations, patterns, and influential factors that shape Tata Electronics' stock performance.

Editor's Notes: Unlock Market Insights: Analyze Tata Electronics Share Price Performance And Trends have published today date, bringing you the latest and most comprehensive analysis of Tata Electronics' share price performance. Understanding these insights is crucial for informed investment decisions and staying ahead in the dynamic stock market.

Through meticulous analysis and in-depth research, we have compiled this guide to empower you with the knowledge and tools needed to navigate the intricacies of Tata Electronics' share price movements.

| Key Differences | Key Takeaways |

|---|---|

| Technical Analysis | Identify potential trading opportunities and price movements based on historical data. |

| Fundamental Analysis | Evaluate the company's financial health, industry trends, and competitive landscape. |

| Market Sentiment Analysis | Gauge investor sentiment and market expectations through social media, news, and expert opinions. |

Transitioning to the main article's topics, we will explore the following:

FAQs

This FAQ section provides clear and concise answers to frequently asked questions about analyzing the share price performance and trends of Tata Electronics. It serves as a valuable resource for investors, analysts, and individuals seeking a deeper understanding of the company's financial health and market dynamics.

Adani Enterprises share price rises ahead of Q4 results; stock in focus - Source www.businesstoday.in

Question 1: What are the key factors driving Tata Electronics' share price performance?

Tata Electronics' share price is influenced by a range of factors, including earnings per share (EPS), revenue growth, overall market sentiment, industry trends, and macroeconomic conditions.

Question 2: How can I evaluate the company's financial health?

In-depth analysis of financial statements, such as the balance sheet, income statement, and cash flow statement, can provide insights into Tata Electronics' financial strength, profitability, and liquidity.

Question 3: What are the key technical indicators used to analyze share price trends?

Technical analysts use various indicators, such as moving averages, Bollinger Bands, and relative strength index (RSI), to identify potential trading opportunities and assess market momentum.

Question 4: How do I identify potential investment opportunities?

Consider factors such as the company's valuation, growth prospects, competitive landscape, and market trends to make informed investment decisions.

Question 5: What resources are available to assist with share price analysis?

Financial news websites, broker research reports, and online platforms provide valuable information and tools for analyzing Tata Electronics' share price.

Question 6: Where can I find up-to-date share price data and analysis?

Real-time share price data and comprehensive analysis are readily accessible through reputable financial websites and mobile applications.

This FAQ section serves as a guide for individuals seeking to enhance their understanding of Tata Electronics' share price performance and trends. By addressing common questions, it provides a foundation for making informed investment decisions.

Moving forward, it is recommended to consult additional resources, such as financial news and expert analysis, to stay abreast of the latest developments and gain a comprehensive perspective on the company's financial trajectory.

Tips

To attain a comprehensive understanding of Tata Electronics' share price trajectory, meticulous analysis is paramount. Unlock Market Insights: Analyze Tata Electronics Share Price Performance And Trends provides a wellspring of information and strategies to assist investors in navigating the intricacies of the company's stock performance.

Tip 1: Monitor Historical Performance

Delving into Tata Electronics' historical share prices is a pivotal step in comprehending its current and future performance. By scrutinizing charts and data, investors can discern patterns, trends, and areas of support and resistance. This knowledge equips them to make informed decisions based on past market behavior.

Tip 2: Evaluate Fundamental Factors

Investors should not overlook the significance of Tata Electronics' underlying financial health and business operations. Analyzing metrics like revenue, earnings, profit margins, and debt levels provides insights into the company's fundamentals. These factors heavily influence share prices, helping investors assess the company's long-term prospects.

Tip 3: Track Market News and Events

Staying abreast of industry-related news, economic developments, and company-specific announcements is crucial. Market-moving events can significantly impact share prices, and investors who remain informed are better positioned to respond swiftly to changes in market sentiment.

Tip 4: Analyze Technical Indicators

Technical analysis involves studying historical price charts to identify patterns and trends. Using technical indicators like moving averages, support and resistance levels, and momentum oscillators, investors can attempt to predict future share price movements and identify potential trading opportunities.

Tip 5: Consider Expert Opinions

Leveraging the insights of industry experts can provide valuable perspective. Consulting financial analysts, reading research reports, and attending investor presentations offer access to diverse viewpoints and professional assessments. However, investors should exercise critical thinking and corroborate information before making investment decisions.

By adhering to these tips, investors can equip themselves with a comprehensive understanding of Tata Electronics' share price performance and trends, empowering them to make informed investment decisions and potentially maximize their returns.

To delve deeper into Tata Electronics' share price analysis and unlock valuable market insights, refer to the comprehensive article Unlock Market Insights: Analyze Tata Electronics Share Price Performance And Trends.

Unlock Market Insights: Analyze Tata Electronics Share Price Performance And Trends

Understanding the performance and trends of Tata Electronics' share price offers valuable insights into the company's financial health and market dynamics. Key aspects to consider include:

- Historical Prices: Tracking historical share prices provides a baseline for evaluating current performance.

- Volume and Liquidity: Analyzing trading volume and liquidity indicates market interest and stock availability.

These aspects provide crucial information for investors and analysts to make informed decisions. By examining historical prices, they can identify patterns and trends that may influence future performance. Monitoring volume and liquidity helps assess the stock's marketability and potential price fluctuations. Additionally, industry news, market conditions, and economic factors all play a role in shaping Tata Electronics' share price, emphasizing the importance of a comprehensive analysis for unlocking valuable market insights.

Engineer - Plant Maintenance (Electrical/Mechanical/Vision) At Tata - Source www.electronicsforu.com

Unlock Market Insights: Analyze Tata Electronics Share Price Performance And Trends

Understanding the market insights of Tata Electronics Share Price Performance and Trends is essential for investors seeking profitable opportunities within the electronics sector. By analyzing key metrics such as stock price movements, trading volume, and market capitalization, investors gain valuable insights into the company's financial health, industry trends, and overall market sentiment.

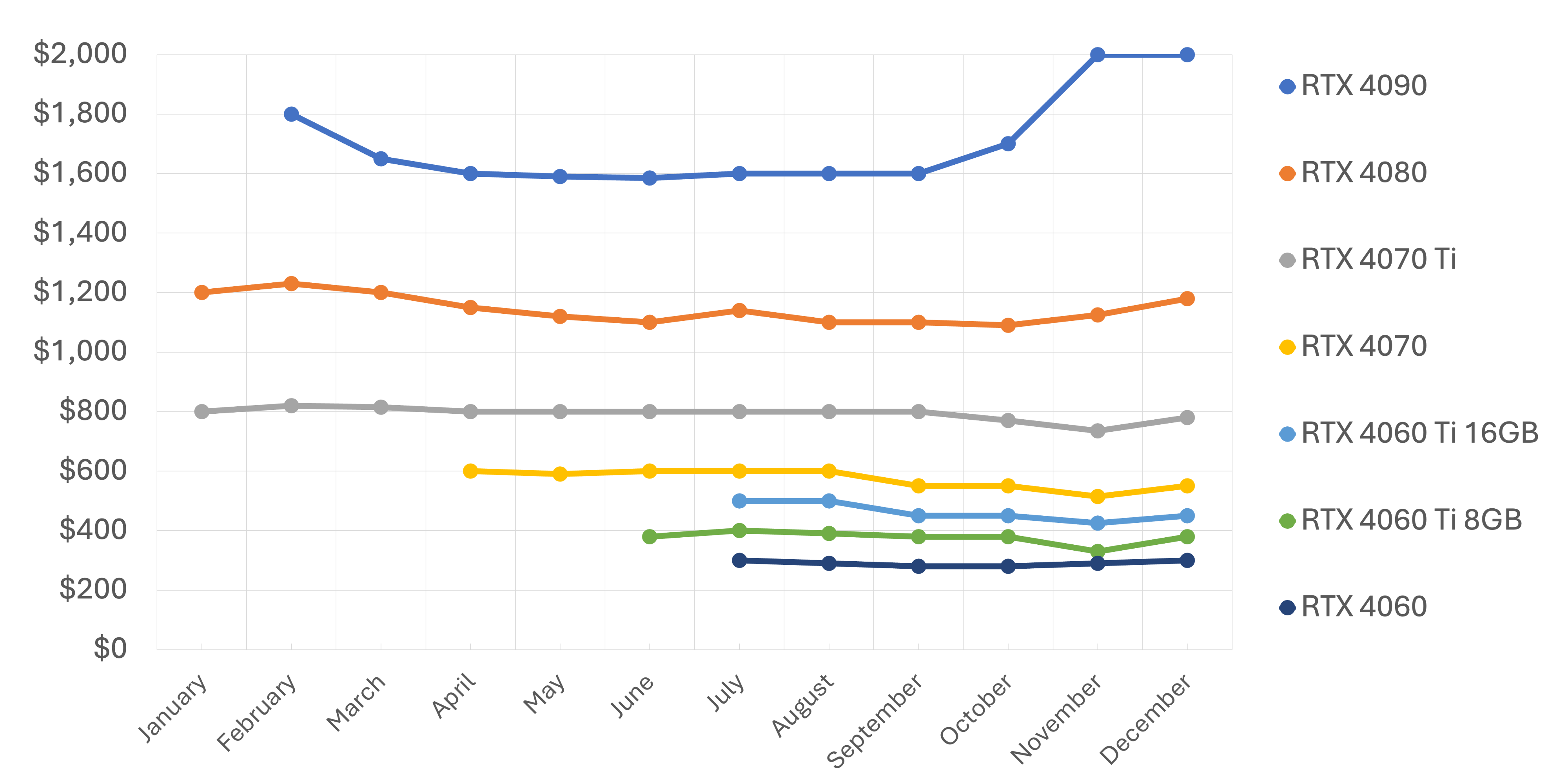

GPU Pricing Update, Year in Review: Price Trends Charted | The Daily Post - Source thedailypost.org

Unlocking market insights involves examining both short-term and long-term trends, assessing the impact of external factors such as economic conditions, technological advancements, and regulatory changes. This analysis aids investors in making informed decisions, managing risk, and maximizing returns.

In-depth analysis of Tata Electronics Share Price Performance And Trends provides crucial information, enabling investors to gauge the company's competitive positioning, identify potential growth areas, and assess the overall stability of the stock. By understanding the connection between market insights and profitable investment strategies, investors increase their chances of success in the dynamic and competitive electronics industry.

| Metric | Importance |

|---|---|

| Stock Price | Measures the current value of the company's shares and market capitalization |

| Trading Volume | Indicates the level of activity in the stock, providing insights into liquidity and investor sentiment |

| Market Capitalization | Represents the total value of the company's outstanding shares, reflecting its size and influence in the industry |

| Industry Trends | Highlights growth opportunities, competitive pressures, and technological advancements within the electronics sector |

| Economic Conditions | Assesses how macroeconomic factors, such as inflation, interest rates, and consumer spending, affect company performance |

Conclusion

Unlocking market insights through the analysis of Tata Electronics Share Price Performance And Trends empowers investors with a comprehensive understanding of the company's financial health, industry dynamics, and overall market sentiment. This knowledge is indispensable in making informed investment decisions, minimizing risk, and maximizing returns. By continuously monitoring and analyzing market data, investors stay ahead of the curve, identify emerging trends, and capitalize on profitable investment opportunities within the electronics sector.

As the electronics industry continues to evolve rapidly, investors must remain vigilant in their market analysis. Unlocking insights from share price performance and trends remains a critical tool for navigating market volatility, harnessing growth potential, and achieving long-term investment success.

Related Posts