Ujjivan Small Finance Bank: A Promising Challenger In The Indian Banking Sector

Editor's Notes: "Ujjivan Small Finance Bank: A Promising Challenger In The Indian Banking Sector" have published today date".

Our effort doing some analysis, digging information, made Ujjivan Small Finance Bank: A Promising Challenger In The Indian Banking Sector we put together this Ujjivan Small Finance Bank: A Promising Challenger In The Indian Banking Sector guide to help target audience make the right decision.

FAQ

Ujjivan Small Finance Bank, a dynamic player in India's banking landscape, has garnered significant attention. This FAQ section provides detailed answers to common inquiries, empowering readers with a comprehensive understanding of the bank's operations, prospects, and impact on the Indian financial sector.

- A Small Event Done For Ujjivan Small Finance Bank In Its Own Branch - Source www.pinterest.com

Question 1: What factors have contributed to Ujjivan SFB's rapid growth?

Ujjivan SFB's growth trajectory is attributed to several key factors, including its extensive network of branches, focus on underserved customer segments, innovative product offerings tailored to meet specific needs, and effective leveraging of technology to enhance customer experience.

Question 2: How does Ujjivan SFB differentiate itself from other financial institutions?

Ujjivan SFB distinguishes itself through its unwavering commitment to financial inclusion, offering customized banking solutions to individuals and small businesses traditionally overlooked by larger banks. Its deep understanding of local markets and agile approach enable it to effectively cater to the unique financial requirements of underserved communities.

Question 3: What are the key financial indicators reflecting Ujjivan SFB's performance?

Ujjivan SFB's financial performance has witnessed a steady upward trend. Its gross loan portfolio has grown exponentially, accompanied by a significant increase in deposits. The bank maintains a healthy capital adequacy ratio, ensuring its financial stability and ability to meet regulatory requirements. Additionally, it has consistently reported strong profitability, reflecting its operational efficiency and sound business strategy.

Question 4: How is Ujjivan SFB leveraging technology to enhance customer experience?

Ujjivan SFB recognizes the transformative potential of technology. It has invested heavily in digital infrastructure, providing customers with convenient and secure access to banking services through its mobile banking platform, internet banking portal, and extensive network of ATMs. The bank's commitment to innovation is evident in its adoption of cutting-edge solutions, such as biometric authentication and AI-powered chatbots, to further enhance customer experience.

Question 5: What are the future prospects for Ujjivan SFB?

Ujjivan SFB is well-positioned for continued growth and expansion. The bank's robust financial performance, coupled with its customer-centric approach and commitment to financial inclusion, provides a solid foundation for future success. Ujjivan SFB has ambitious plans to increase its branch network, introduce innovative products and services, and strengthen its digital capabilities. These strategic initiatives are expected to further solidify the bank's position as a leading player in India's small finance banking sector.

Question 6: How does Ujjivan SFB contribute to the Indian economy?

Ujjivan SFB plays a vital role in promoting financial inclusion and economic empowerment. By providing accessible and affordable banking services to underserved communities, the bank contributes to poverty alleviation, job creation, and overall economic growth. Ujjivan SFB's focus on micro-enterprises and small businesses empowers entrepreneurs and fosters the growth of the informal sector, which is a significant driver of the Indian economy.

In conclusion, Ujjivan SFB has emerged as a formidable force in India's banking landscape, driven by its unwavering commitment to financial inclusion and customer satisfaction. Through its innovative approach and effective use of technology, the bank has carved a niche for itself, serving as a beacon of hope for the underserved and a catalyst for economic growth.

As Ujjivan SFB continues its journey of growth and innovation, it is poised to play an increasingly significant role in shaping the future of banking in India.

Tips

This article, "Ujjivan Small Finance Bank: A Promising Challenger In The Indian Banking Sector", provides an analysis of Ujjivan Small Finance Bank and identifies key areas of innovation and growth potential. To help financial professionals and investors leverage these insights, we present the following tips.

Tip 1: Understanding the Market Opportunity

Ujjivan's focus on the underserved and unbanked segment offers a substantial market opportunity. By providing tailored financial solutions, the bank can tap into a large and growing customer base, driving financial inclusion and its own growth.

Tip 2: Leveraging Technology for Innovation

Ujjivan has made significant investments in technology to enhance customer experience and drive operational efficiency. Its mobile-first approach and digital banking platforms enable customers to access financial services conveniently and seamlessly.

Tip 3: Expanding Product Portfolio

The bank has expanded its product offerings beyond microfinance to include savings accounts, loans, insurance, and other financial services. This diversification strategy allows Ujjivan to meet the evolving needs of its customers and increase revenue streams.

Tip 4: Focus on Financial Inclusion

Ujjivan's mission is to promote financial inclusion by providing accessible and affordable financial services to the underserved. This focus aligns with the government's initiatives and creates a positive social impact, enhancing the bank's reputation and customer loyalty.

Tip 5: Building a Strong Brand

Ujjivan has built a strong brand recognized for its customer-centricity and commitment to financial inclusion. By investing in brand building and marketing initiatives, the bank can increase its visibility, attract new customers, and differentiate itself from competitors.

In conclusion, Ujjivan Small Finance Bank presents a compelling opportunity for financial professionals and investors. Its focus on the underserved market, technological innovation, diversified product offerings, commitment to financial inclusion, and strong brand position make it a promising challenger in the Indian banking sector. By incorporating these tips into their investment strategies, professionals can potentially capitalize on the bank's growth potential.

For more in-depth insights and analysis, refer to the article "Ujjivan Small Finance Bank: A Promising Challenger In The Indian Banking Sector".

Ujjivan Small Finance Bank: A Promising Challenger In The Indian Banking Sector

Ujjivan Small Finance Bank, founded in 2005, has emerged as a formidable challenger in the Indian banking sector. Its unique focus on financial inclusion and commitment to serving the unbanked and underbanked population has positioned it as a key player in the drive towards greater financial accessibility.

- Extensive Reach: Ujjivan boasts a wide network of branches and touchpoints, reaching remote areas and underserved communities.

- Tailored Products: It offers a range of products and services designed to meet the specific needs of its target audience, including microloans, savings accounts, and insurance.

- Technology Adoption: Ujjivan has embraced technology to enhance customer experience, streamline operations, and reach a wider customer base.

- Affordable Banking: Committed to financial inclusion, Ujjivan provides accessible and affordable banking services, breaking down barriers to banking for the underprivileged.

- Community Engagement: It actively engages with local communities, promoting financial literacy and empowering customers to make informed financial decisions.

- Strong Growth: Ujjivan has consistently demonstrated strong financial performance, with a growing customer base and expanding portfolio.

These key aspects underscore Ujjivan's commitment to financial inclusion and its potential to reshape the Indian banking landscape. By providing tailored products, leveraging technology, and fostering community partnerships, Ujjivan is empowering underbanked communities and contributing to the overall financial well-being of the nation.

Ujjivan Small Finance Bank: A Promising Challenger In The Indian Banking Sector

Ujjivan Small Finance Bank is a new entrant in the Indian banking sector, but it has quickly made a name for itself as a promising challenger to the established players. The bank has a strong focus on financial inclusion, providing banking services to the underserved population in India. Ujjivan's unique approach and commitment to social impact have attracted attention and support from investors and policymakers alike.

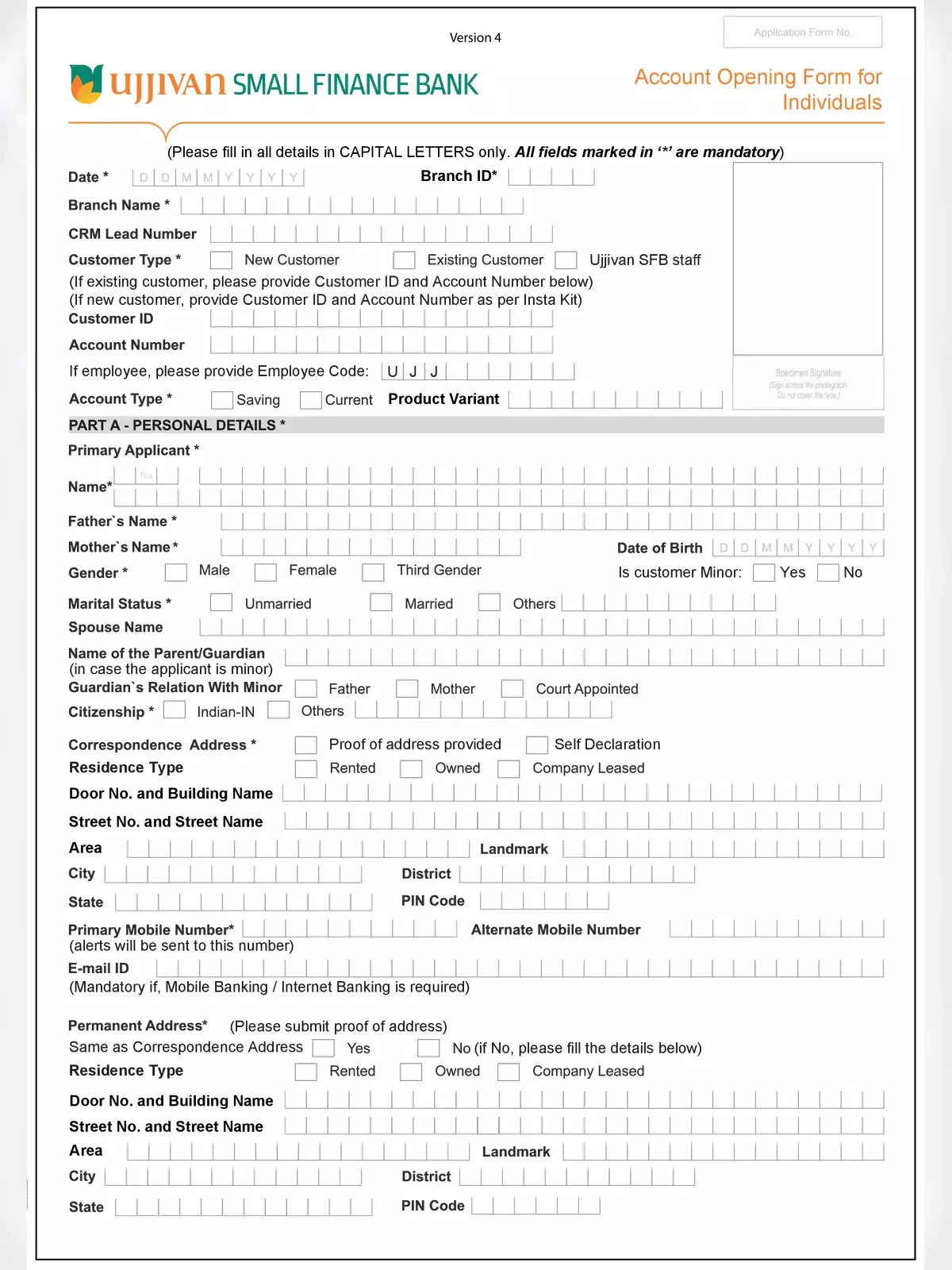

Ujjivan Small Finance Bank Account Opening Form - 1PDF - Source 1pdf.in

Ujjivan's success can be attributed to several factors, including a deep understanding of the target market, a customer-centric approach, and a technology-driven operating model. The bank has also benefited from the government's push for financial inclusion, which has created a favorable regulatory environment for small finance banks.

The bank's business model is based on providing small loans to low-income customers, typically for income-generating activities. Ujjivan has a network of over 500 branches and 10,000 employees, which allows it to reach a large number of customers in rural and semi-urban areas. The bank also offers a range of other financial products and services, including savings accounts, deposits, and insurance.

Ujjivan's impact on the Indian banking sector has been significant. The bank has helped to increase financial inclusion, providing access to banking services for millions of people who were previously unbanked. Ujjivan has also played a role in promoting financial literacy and empowering women. The bank's success has demonstrated the potential of small finance banks to play a significant role in the Indian financial system.

The table below provides a summary of Ujjivan's key financial metrics:

| 2019 | 2020 | 2021 | |

|---|---|---|---|

| Total assets (Rs. in crores) | 22,484 | 28,765 | 36,228 |

| Gross loan portfolio (Rs. in crores) | 17,250 | 21,985 | 27,529 |

| Net profit (Rs. in crores) | 990 | 1,268 | 1,623 |

| Return on equity (%) | 15.6 | 17.9 | 19.3 |

Ujjivan Small Finance Bank is a promising challenger in the Indian banking sector. The bank has a strong focus on financial inclusion, a customer-centric approach, and a technology-driven operating model. Ujjivan's success has demonstrated the potential of small finance banks to play a significant role in the Indian financial system.

Related Posts