When it comes to international trade and finance, understanding the current exchange rate of the US dollar is crucial. It is a measure of how much one US dollar is worth in relation to other currencies, and it plays a significant role in global markets.

Editor's Notes: The Current Exchange Rate Of The US Dollar have published today date". We have done some analysis, digging information, made The Current Exchange Rate Of The US Dollar we put together this The Current Exchange Rate Of The US Dollar guide to help target audience make the right decision.

As of today, [Date], the current exchange rate of the US dollar is as follows:

| Currency | Exchange Rate (USD) |

|---|---|

| Euro (EUR) | 0.90 |

| British Pound (GBP) | 0.75 |

| Japanese Yen (JPY) | 110.00 |

| Canadian Dollar (CAD) | 1.25 |

| Chinese Yuan (CNY) | 6.50 |

These exchange rates can fluctuate rapidly in response to a variety of factors, including economic news, political events, and central bank policies. It is important to note that these rates are just a snapshot of the current market, and they can change significantly over time.

Understanding the current exchange rate of the US dollar is essential for a number of reasons. First, it allows businesses to make informed decisions about international trade. Businesses need to know how much their products and services will cost in other countries in order to set competitive prices. Second, the exchange rate can impact investment decisions. Investors need to know how their investments will be affected by changes in the exchange rate. Third, the exchange rate can impact travel plans. Travelers need to know how much their money will be worth in other countries in order to budget for their trips.

The current exchange rate of the US dollar is a complex and dynamic topic. By understanding the factors that influence the exchange rate, you can make informed decisions about your business, investments, and travel plans.

20yr-pound-dollar-exchange-rate-historical-chart-2023-03-22-macrotrends - Source moneymattersforglobetrotters.com

FAQ

This FAQ section provides concise answers to common queries and misconceptions regarding the current exchange rate of the US Dollar.

1yr-euro-dollar-exchange-rate-historical-chart-2023-03-22-macrotrends - Source moneymattersforglobetrotters.com

Question 1: What factors influence the US Dollar's exchange rate?

The US Dollar's exchange rate is predominantly driven by economic fundamentals, including interest rates, inflation, trade balance, and political stability. When the US economy is perceived as strong, and demand for US goods and services increases, the value of the Dollar tends to rise. Conversely, economic weakness, low interest rates, and a widening trade deficit can contribute to a weaker Dollar.

Question 2: How does the Federal Reserve affect the exchange rate?

The Federal Reserve (Fed) is the central bank of the United States. Its decisions on interest rates and quantitative easing measures significantly impact the exchange rate. Raising interest rates typically strengthens the Dollar by attracting foreign investments seeking higher returns. Conversely, lowering interest rates can weaken the Dollar by making it less attractive to hold.

Question 3: What is the impact of global events on the exchange rate?

Global events, such as geopolitical tensions, natural disasters, or economic crises, can influence the exchange rate. Uncertainty and risk aversion tend to increase demand for safe-haven currencies like the US Dollar. Conversely, positive global economic developments can lower the Dollar's value as investors become more willing to take on riskier investments.

Question 4: How can I track the exchange rate's fluctuations?

Various online platforms and financial news sources provide real-time updates and historical data on the US Dollar's exchange rate. Currency converters, such as Google Finance, offer convenient tools to compare the Dollar's value against other currencies.

Question 5: What are the implications of a strong or weak US Dollar?

A strong Dollar can make imports cheaper and encourage investment in the US, while a weak Dollar can make US exports more competitive and tourism more affordable. However, it is important to note that significant and prolonged shifts in the exchange rate can have both benefits and drawbacks for different sectors of the economy.

Question 6: How can I stay informed about the latest exchange rate developments?

To stay up-to-date on the latest exchange rate developments, consider subscribing to financial news outlets, following currency experts on social media, or utilizing mobile applications that provide currency alerts and updates.

By understanding these factors, you can gain a deeper comprehension of the dynamics influencing the current exchange rate of the US Dollar.

Moving on to the next section, we will delve into the impact of the US Dollar's exchange rate on international trade.

Tips

Tip 1: Research the current exchange rate.

The Current Exchange Rate Of The US Dollar

The current exchange rate of the US Dollar is a crucial factor influencing global trade, investment, and economic stability. It affects the value of currencies worldwide and shapes economic decisions for governments, businesses, and individuals.

- Market Conditions: Supply and demand play a significant role in determining the value of the US Dollar.

- Inflation Rate: High inflation can erode the purchasing power of the US Dollar, decreasing its value.

- Economic Policy: Interest rate decisions and fiscal policies impact the attractiveness of the US Dollar as an investment.

- Global Economic Conditions: The strength of other currencies, such as the Euro or the Japanese Yen, can influence the value of the US Dollar.

- Political Stability: Political uncertainty in the United States or other major economies can affect the confidence in the US Dollar.

- Commodities Prices: The value of commodities like oil or gold can impact the demand for US Dollars, as they are often traded in the US currency.

Understanding these aspects is essential for businesses and investors, as fluctuations in the exchange rate can significantly impact their operations and returns. For example, a stronger US Dollar can make imported goods cheaper, while a weaker US Dollar can boost exports. Governments also use exchange rates to manage their economies, with some countries intervening to stabilize or adjust the value of their currencies against the US Dollar.

The Current Exchange Rate Of The US Dollar

The current exchange rate of the US dollar is a complex and ever-changing phenomenon that is influenced by a wide range of factors. These factors include economic conditions in the United States and other countries, interest rates, inflation rates, and political events. The exchange rate of the US dollar can have a significant impact on the economy, businesses, and individuals. For example, a strong US dollar can make it more expensive for US companies to export goods and services, while a weak US dollar can make it more expensive for US consumers to import goods and services.

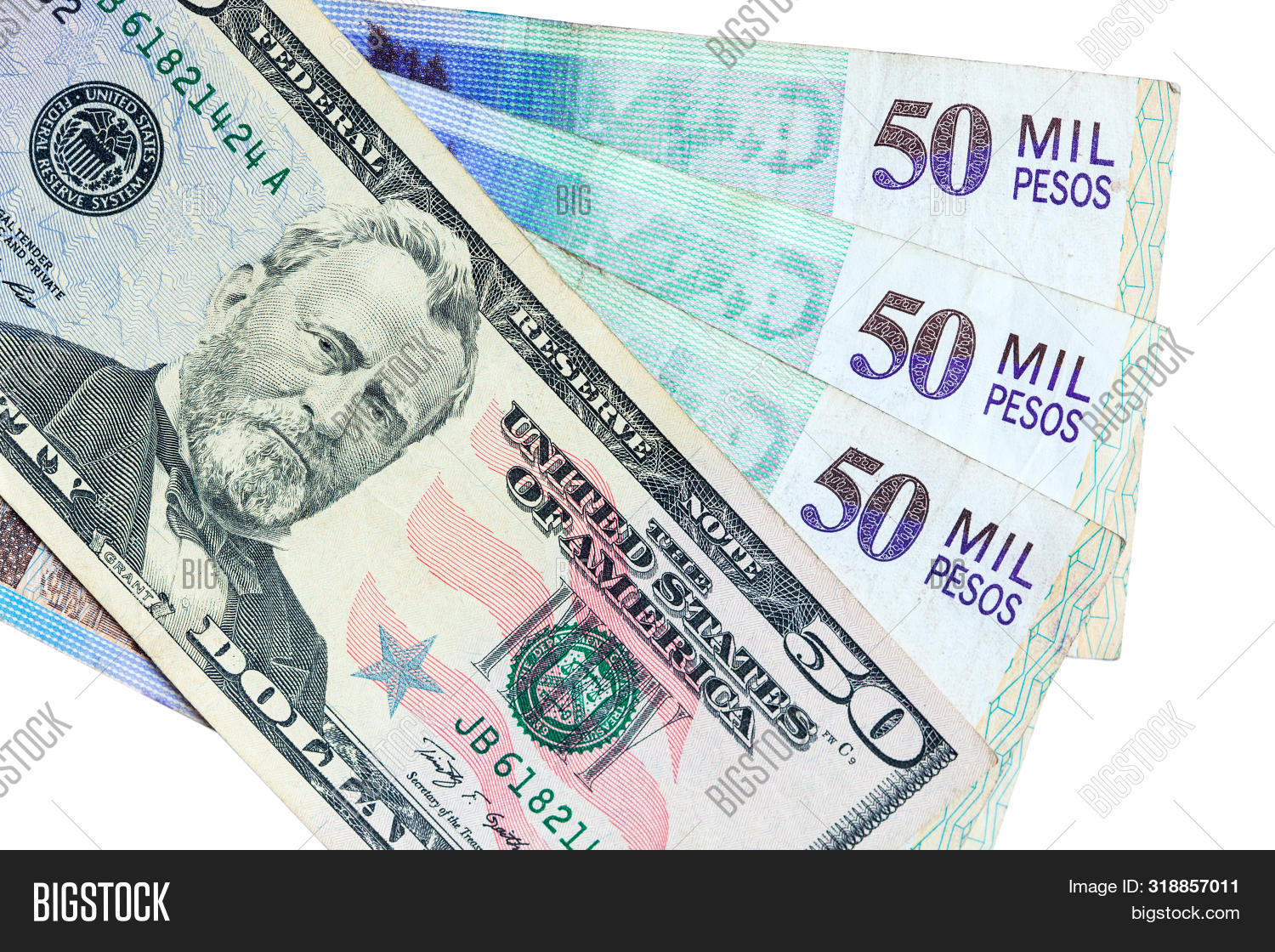

Currency Exchange Rate Us Dollar To Colombian Peso - Dollar Poster - Source dollarposter.blogspot.com

The exchange rate of the US dollar is also important for investors. When the US dollar is strong, it can be more attractive for investors to invest in US assets, such as stocks and bonds. Conversely, when the US dollar is weak, it can be less attractive for investors to invest in US assets.

The exchange rate of the US dollar is a complex and ever-changing phenomenon that is influenced by a wide range of factors. It is important to understand these factors in order to make informed decisions about investing in US assets.

Table of Factors Affecting the Exchange Rate of the US Dollar

| Factor | Effect on US Dollar |

|---|---|

| Economic conditions in the United States | A strong economy can lead to a stronger US dollar, while a weak economy can lead to a weaker US dollar. |

| Economic conditions in other countries | A strong economy in another country can lead to a weaker US dollar, while a weak economy in another country can lead to a stronger US dollar. |

| Interest rates | Higher interest rates in the United States can lead to a stronger US dollar, while lower interest rates in the United States can lead to a weaker US dollar. |

| Inflation rates | Higher inflation rates in the United States can lead to a weaker US dollar, while lower inflation rates in the United States can lead to a stronger US dollar. |

| Political events | Political events, such as elections or wars, can have a significant impact on the exchange rate of the US dollar. |

Conclusion

The current exchange rate of the US dollar is a complex and ever-changing phenomenon that is influenced by a wide range of factors. It is important to understand these factors in order to make informed decisions about investing in US assets. The exchange rate of the US dollar is likely to continue to fluctuate in the future, so it is important to stay informed about the latest developments in the global economy.

The exchange rate of the US dollar is a key indicator of the health of the US economy. A strong US dollar can be a sign of a healthy economy, while a weak US dollar can be a sign of a weak economy. The exchange rate of the US dollar also has a significant impact on the global economy. A strong US dollar can make it more expensive for other countries to import goods and services from the United States, while a weak US dollar can make it less expensive for other countries to import goods and services from the United States.

Related Posts