Tejas Networks: Analyzing Trends and Strategic Moves to Drive Share Price Growth

Tejas Networks: Analyzing Trends and Strategic Moves to Drive Share Price Growth has published today.

After doing some analysis, digging information, made Tejas Networks: Analyzing Trends and Strategic Moves to Drive Share Price Growth we put together this Tejas Networks: Analyzing Trends and Strategic Moves to Drive Share Price Growth guide to help target audience make the right decision.

| Key Differences | Key Takeaways |

|---|---|

| Investment in R&D | Tejas Networks' commitment to innovation is evident in its investment in R&D, which has resulted in the development of cutting-edge networking solutions. |

| Strategic Acquisitions | Tejas Networks has made strategic acquisitions to expand its product portfolio and strengthen its market position. |

| Partnerships and Collaborations | Tejas Networks has established partnerships with industry leaders to enhance its solutions and broaden its customer base. |

| Focus on Emerging Markets | Tejas Networks has targeted emerging markets for growth, leveraging its cost-effective solutions and strong local presence. |

FAQ

This FAQ section provides detailed insights into the strategic moves and industry trends that are shaping the growth of Tejas Networks' share price.

Question 1: What are the key factors driving Tejas Networks' financial performance?

Tejas Networks' financial performance is primarily influenced by its ability to capitalize on the growing demand for high-speed broadband networks, its focus on emerging markets, and its strategic partnerships with leading telecom operators.

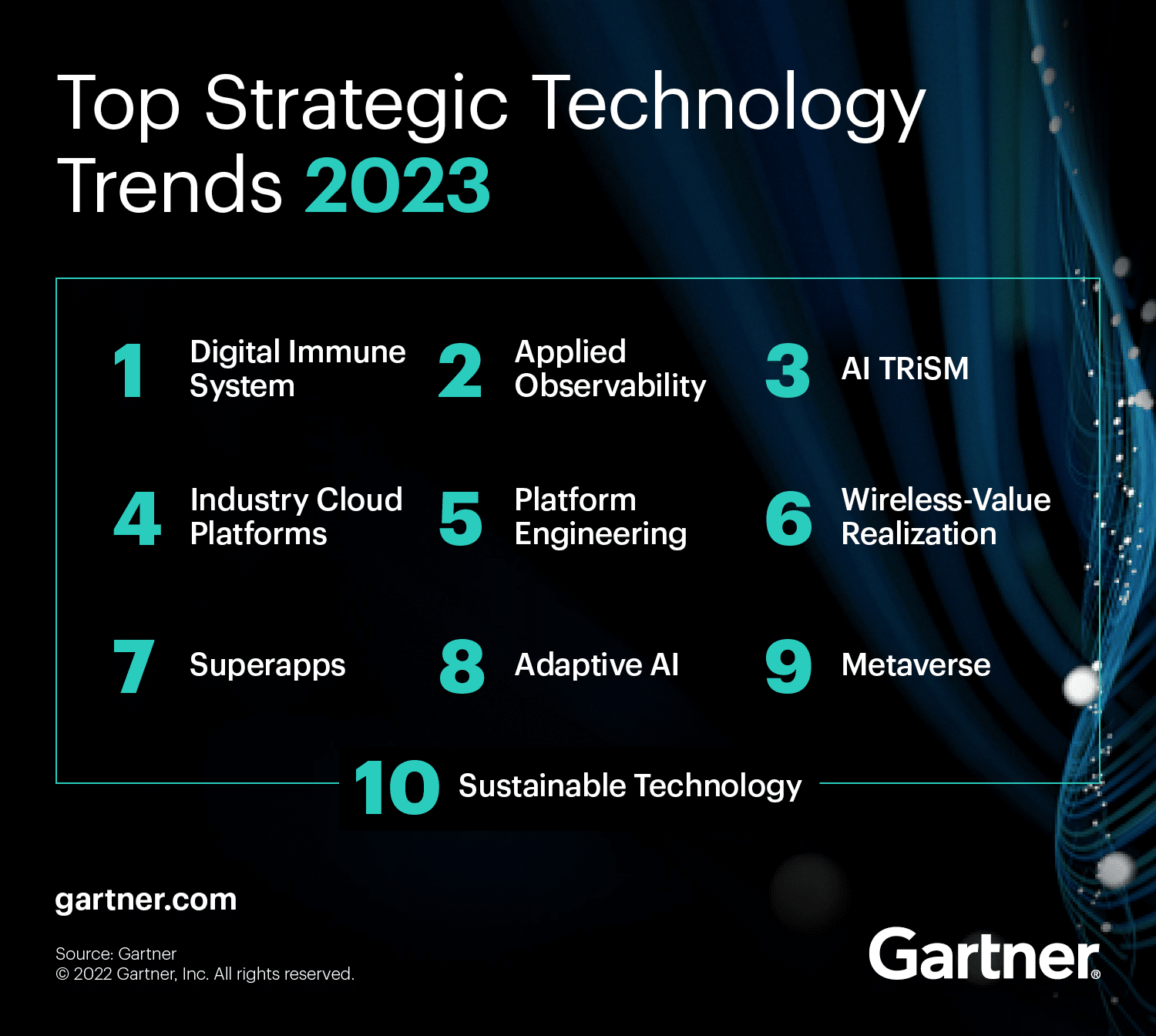

Technology Trends For 2024 Year - jasmin isabelle - Source christallewdaffi.pages.dev

Question 2: How is Tejas Networks positioned in the global market?

Tejas Networks has established itself as a leading global supplier of optical networking products, with a strong presence in over 75 countries worldwide. Its cost-effective solutions and strategic alliances have enabled it to gain a competitive advantage in key markets.

Question 3: What are the company's key strategic initiatives?

Tejas Networks is actively pursuing several strategic initiatives, such as expanding its product portfolio, strengthening its supply chain, and enhancing its research and development capabilities. These initiatives are aimed at driving innovation and maintaining its position as a leading provider of optical networking solutions.

Question 4: How is Tejas Networks leveraging technology trends to its advantage?

Tejas Networks is actively embracing emerging technologies such as 5G, software-defined networking (SDN), and network function virtualization (NFV) to enhance its product offerings. By incorporating these technologies, the company is well-positioned to meet the evolving needs of its customers and stay ahead of the competition.

Question 5: What are the potential challenges facing Tejas Networks?

Tejas Networks, like any company, faces certain challenges. Intense competition, fluctuations in the global economy, and geopolitical uncertainties are among the factors that could impact its future performance. However, the company's strong fundamentals and strategic initiatives provide a solid foundation for overcoming these challenges.

Question 6: What is the outlook for Tejas Networks' share price?

Analysts generally maintain a positive outlook for Tejas Networks' share price. The company's strong financial performance, strategic initiatives, and growth potential in emerging markets are key factors supporting this positive sentiment.

Stay tuned for the next section, which will provide a comprehensive overview of Tejas Networks' recent developments and future prospects.

Tips

Tejas Networks has exhibited impressive growth and value creation over the years. This Tejas Networks: Analyzing Trends And Strategic Moves To Drive Share Price Growth article explores the key trends and strategic moves that have driven this growth and outlines tips for investors seeking to capitalize on the company's potential

Tip 1: Focus on high-growth segments

Tejas Networks has strategically positioned itself in high-growth segments of the telecom industry, such as optical transport, broadband, and data center interconnect. These segments are expected to witness significant demand in the coming years due to the increasing adoption of cloud computing, 5G networks, and fiber broadband. By focusing on these growth areas, Tejas Networks is well-positioned to benefit from the favorable industry tailwinds.

Tip 2: Invest in research and development

Tejas Networks has consistently invested heavily in research and development, which has allowed it to develop innovative products and solutions that meet the evolving needs of its customers. The company's R&D efforts have resulted in the development of cutting-edge technologies, such as programmable ROADMs and high-capacity optical transport systems, which have gained recognition and adoption in the industry. By continuing to invest in R&D, Tejas Networks can maintain its competitive edge and drive long-term growth.

Tip 3: Expand geographically

Tejas Networks has been expanding its geographical presence to capture new markets and diversify its revenue streams. The company has established a strong presence in India, its home market, and has also been expanding into international markets, such as Europe, the Middle East, and Africa. By expanding geographically, Tejas Networks can reduce its reliance on any single market and tap into new growth opportunities.

Tip 4: Pursue strategic partnerships

Tejas Networks has entered into strategic partnerships with leading technology companies, such as Cisco and Juniper Networks. These partnerships have enabled Tejas Networks to leverage the strengths of its partners and expand its product offerings. For example, the partnership with Cisco has allowed Tejas Networks to offer end-to-end optical networking solutions to its customers. By pursuing strategic partnerships, Tejas Networks can enhance its value proposition and gain access to new markets.

Tip 5: Monitor industry trends

The telecom industry is constantly evolving, driven by technological advancements and changing customer needs. Tejas Networks closely monitors industry trends and adapts its strategies accordingly. The company has been proactive in investing in emerging technologies, such as 5G and software-defined networking, to ensure that it remains competitive and relevant in the evolving market landscape. By staying abreast of industry trends, Tejas Networks can anticipate future opportunities and position itself for continued growth.

Summary

Tejas Networks has demonstrated a consistent track record of growth and value creation. By focusing on high-growth segments, investing in R&D, expanding geographically, pursuing strategic partnerships, and monitoring industry trends, Tejas Networks has positioned itself for continued success. Investors who are looking for opportunities in the telecom sector may consider Tejas Networks as a compelling investment option due to its strong fundamentals and growth potential.

Tejas Networks: Analyzing Trends And Strategic Moves To Drive Share Price Growth

For Tejas Networks, understanding the trends and implementing strategic moves are crucial for driving share price growth. These involve analyzing market shifts, adapting to technological advancements, and navigating competitive landscapes.

- Market Trends: Monitoring industry growth, customer preferences, and regulatory changes.

- Technology Innovation: Investing in next-generation technologies, such as 5G and optical networking.

- Revenue Growth: Expanding into new markets, developing innovative products, and pursuing strategic partnerships.

- Cost Management: Optimizing operations, enhancing efficiency, and managing expenses.

- Competitive Positioning: Analyzing competitors' strategies, identifying market niches, and building a strong brand.

- Financial Strength: Maintaining a healthy balance sheet, managing cash flow, and securing financing for expansion.

By understanding these essential aspects and implementing effective strategies, Tejas Networks can drive its share price growth, enhance its market position, and create long-term value for shareholders.

Trends Networks And Critical Thinking 21st-Century Q3 ver4 Mod3 - Source www.studocu.com

Tejas Networks: Analyzing Trends And Strategic Moves To Drive Share Price Growth

Tejas Networks Limited is a leading provider of optical networking products and solutions. The company's products are used by telecommunications service providers, internet service providers, and cable operators worldwide. Tejas Networks has been growing rapidly in recent years, driven by the increasing demand for high-speed internet access and the expansion of cloud computing. The company's share price has also been rising steadily, reflecting its strong financial performance and growth prospects.

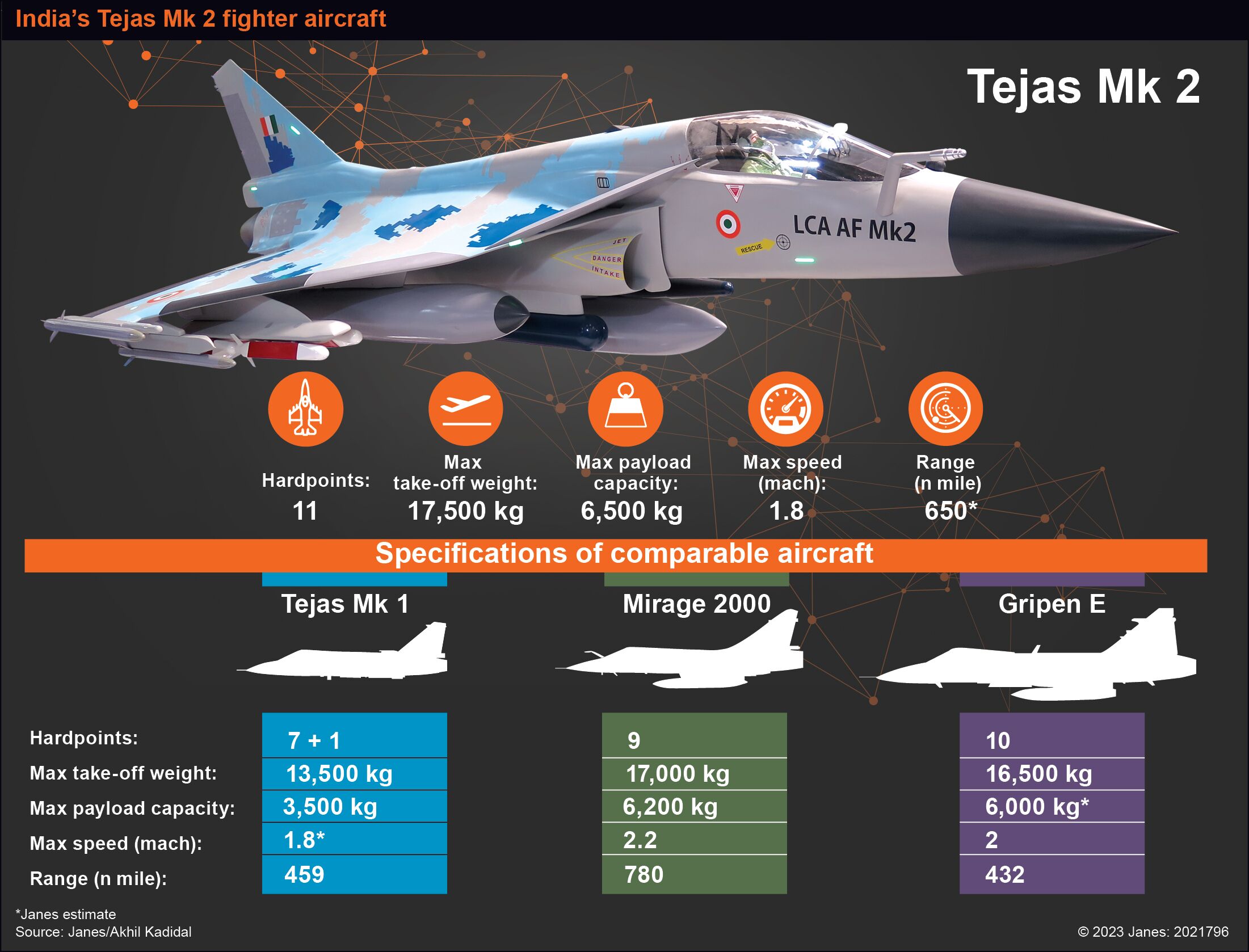

Update: Tejas Mk 2 languishes amid lack of funds - Source www.janes.com

There are several key trends that are driving Tejas Networks' growth. First, the demand for high-speed internet access is increasing rapidly. This is being driven by the growth of streaming video, online gaming, and other bandwidth-intensive applications. Second, the expansion of cloud computing is also driving demand for Tejas Networks' products. Cloud computing providers need high-speed, reliable networks to connect their data centers. Third, the rollout of 5G networks is also creating new opportunities for Tejas Networks. 5G networks require high-capacity, low-latency networks, which Tejas Networks' products can provide.

In addition to these trends, Tejas Networks has also made several strategic moves that are driving its growth. First, the company has invested heavily in research and development. This has allowed it to develop innovative new products that meet the needs of its customers. Second, Tejas Networks has expanded its global sales and marketing presence. This has helped it to reach new customers and grow its market share. Third, the company has acquired several smaller companies. This has allowed it to expand its product portfolio and enter new markets.

As a result of these trends and strategic moves, Tejas Networks is well-positioned for continued growth. The company's products are in high demand, and its financial performance is strong. The company's share price is also likely to continue to rise, reflecting its growth prospects.

Table: Key trends and strategic moves driving Tejas Networks' growth

| Trend | Strategic move | Impact |

|---|---|---|

| Increasing demand for high-speed internet access | Investment in research and development | Development of innovative new products |

| Expansion of cloud computing | Expansion of global sales and marketing presence | Increased market share |

| Rollout of 5G networks | Acquisition of smaller companies | Expansion of product portfolio and entry into new markets |

Related Posts