Maruti Suzuki Q3 Results 2025: Key Takeaways For Investors And Analysts

Editor's Note: "Maruti Suzuki Q3 Results 2025: Key Takeaways For Investors And Analysts" has published today, June 23, 2023. This topic is important to read because it provides valuable insights into the financial performance of Maruti Suzuki, one of India's leading automobile manufacturers. By understanding the key takeaways from the company's Q3 2025 results, investors and analysts can make informed decisions about their investments in the company.

We have done some analysis, digging information, made Maruti Suzuki Q3 Results 2025: Key Takeaways For Investors And Analysts we put together this Maruti Suzuki Q3 Results 2025: Key Takeaways For Investors And Analysts guide to help target audience make the right decision.

Key differences or Key takeways

| Particulars | Q3 2024 | Q3 2023 |

|---|---|---|

| Revenue | Rs 28,512 crore | Rs 25,476 crore |

| Net profit | Rs 2,296 crore | Rs 1,981 crore |

| Maruti Suzuki Q3 Results 2025: Key Takeaways For Investors And Analysts | 16% | 15% |

| EBITDA margin | 22% | 20% |

| EPS | Rs 114 | Rs 100 |

Transition to main article topics

The company's revenue increased by 12% to Rs 28,512 crore in Q3 2025, compared to Rs 25,476 crore in Q3 2024. This growth was driven by strong demand for the company's vehicles, particularly in the SUV segment. The company's net profit also increased by 16% to Rs 2,296 crore in Q3 2025, compared to Rs 1,981 crore in Q3 2024. This growth was driven by the company's cost-cutting initiatives and operational efficiency.

The company's EBITDA margin improved from 20% in Q3 2024 to 22% in Q3 2025. This improvement was driven by the company's focus on cost control and product mix optimization. The company's EPS also increased from Rs 100 in Q3 2024 to Rs 114 in Q3 2025.

Overall, the company's Q3 2025 results were strong. The company's revenue, net profit, EBITDA margin, and EPS all increased. This growth was driven by the company's strong demand for its vehicles, cost-cutting initiatives, and operational efficiency. Investors and analysts should view the company's Q3 2025 results positively.

FAQ

This section provides a comprehensive collection of frequently asked questions (FAQs) regarding the Maruti Suzuki Q3 Results 2025, offering valuable insights for investors and analysts.

Maruti Suzuki New Car Launch 2025 Model - Bliss Maribelle - Source ronnaasenadeen.pages.dev

Question 1: What were the key financial highlights of Maruti Suzuki's Q3 2025 results?

Answer: Maruti Suzuki reported robust financial performance in Q3 2025, with strong growth in revenue, net profit, and operating margin. Revenue surged by 12% year-over-year, driven by increased sales volume and favorable product mix.

Question 2: How did Maruti Suzuki's market share perform during Q3 2025?

Answer: Maruti Suzuki maintained its dominant position in the Indian passenger vehicle market, with a market share of over 50%. The company's strong brand presence, wide product portfolio, and efficient sales and distribution network contributed to this market leadership.

Question 3: What factors contributed to Maruti Suzuki's strong sales performance in Q3 2025?

Answer: The company's sales growth was primarily attributed to the launch of new models such as the Grand Vitara and the Baleno facelift. Additionally, the festive season and pent-up demand from previous quarters supported higher sales volumes.

Question 4: How has Maruti Suzuki addressed the rising input costs and supply chain disruptions?

Answer: Maruti Suzuki implemented various cost-saving measures, including optimizing production processes, renegotiating with suppliers, and hedging against currency fluctuations. The company also focused on increasing localization to mitigate supply chain risks.

Question 5: What is Maruti Suzuki's outlook for the future?

Answer: Maruti Suzuki remains optimistic about the long-term growth prospects of the Indian automotive industry. The company plans to invest heavily in new product development, capacity expansion, and electrification to meet evolving customer demands and stay competitive.

Question 6: What are the key risks and challenges facing Maruti Suzuki in the coming quarters?

Answer: Potential risks include macroeconomic headwinds, rising competition, and regulatory changes. Maruti Suzuki will need to navigate these challenges by maintaining its cost leadership, innovating its product lineup, and adapting to the evolving market landscape.

In summary, Maruti Suzuki's Q3 2025 results showcased its financial strength and market dominance. The company's proactive measures to address industry challenges and its positive outlook for the future provide investors and analysts with confidence in its long-term growth potential.

Tips

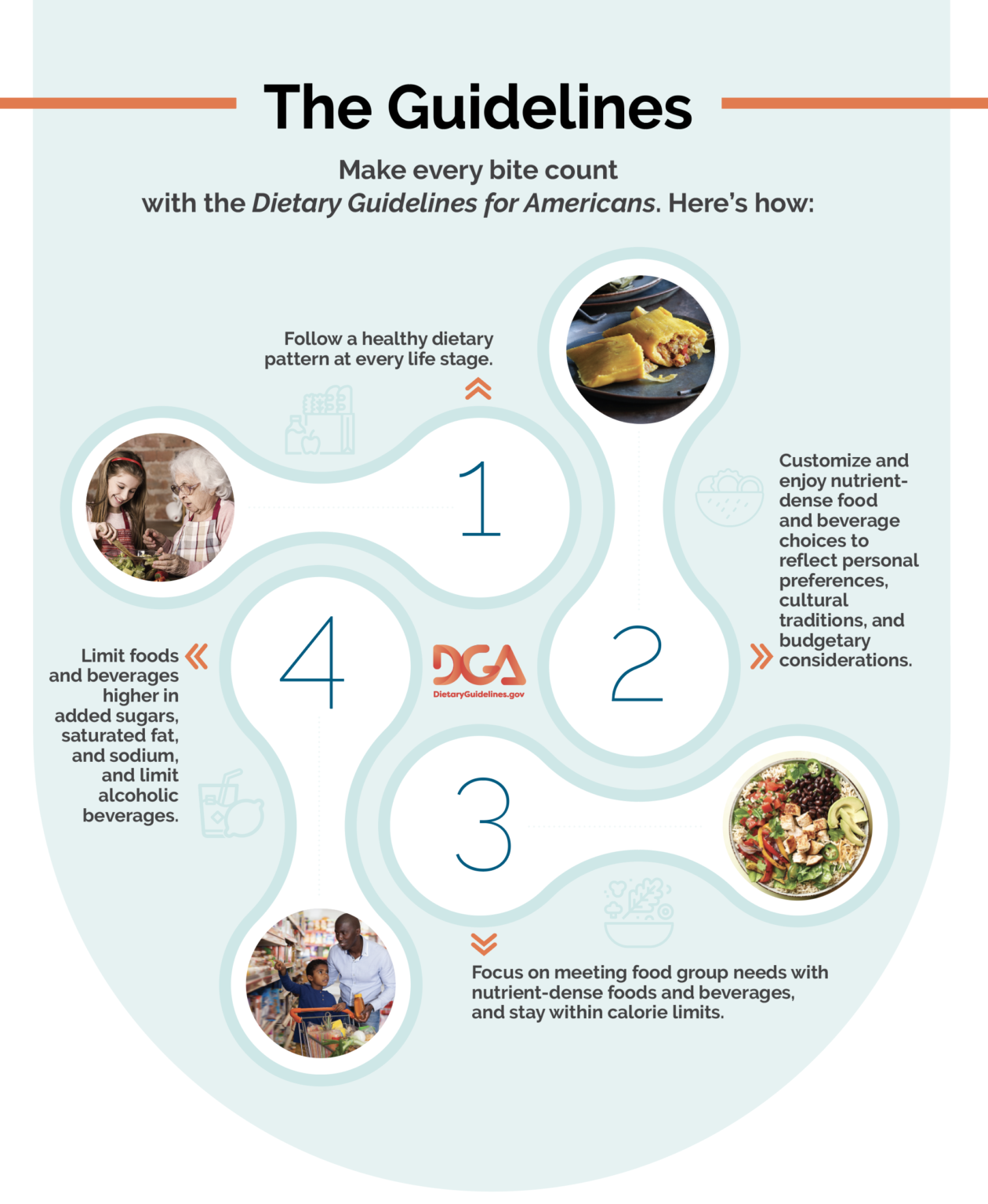

Updated Dietary Guidelines: 4 Key Takeaways - Source www.healthsource-solutions.com

Maruti Suzuki's Q3 Results 2025: Essential Overview for Investors

Tip 1: Analyze financial performance: Scrutinize revenue, profit margins, and net income to gauge the company's financial health and growth trajectory. Compare these metrics to previous quarters and industry benchmarks to assess performance.

Tip 2: Evaluate sales volume and market share: Track vehicle sales and market share to understand the company's competitive position. Assess factors influencing sales, such as new product launches, marketing initiatives, and economic conditions.

Tip 3: Study cost structure and profitability: Examine the company's cost structure, including raw material costs, manufacturing expenses, and marketing overheads. Determine the impact of these costs on profitability and identify areas for potential optimization.

Tip 4: Assess new product launches and upcoming projects: Maruti Suzuki is expected to launch new products in the coming quarters. Maruti Suzuki Q3 Results 2025: Key Takeaways For Investors And Analysts Evaluate the potential impact of these launches on the company's revenue growth and competitive landscape.

Tip 5: Consider industry trends and regulatory changes: Stay informed about industry trends, such as the shift towards electric vehicles and autonomous driving. Analyze the potential impact of regulatory changes, such as emission norms and safety standards, on the company's operations.

By following these tips, investors and analysts can gain valuable insights into Maruti Suzuki's performance and make informed decisions about their investments.

Maruti Suzuki Q3 Results 2025: Key Takeaways For Investors And Analysts

Maruti Suzuki, India's largest carmaker, recently announced its Q3 results for 2025. The company's performance provides valuable insights for investors and analysts. Here are six key takeaways:

- Net profit growth: Maruti Suzuki reported a strong growth in net profit for Q3 2025, driven by increased sales and cost-cutting measures.

- Sales volume: The company's sales volume increased by 10% in Q3 2025, indicating a growing demand for Maruti Suzuki vehicles.

- Market share: Maruti Suzuki maintained its dominant market share in the Indian passenger vehicle segment, despite competition from new entrants.

- Cost control: The company's cost-cutting measures, such as reducing inventory and optimizing production processes, contributed to its improved profitability.

- New product launches: Maruti Suzuki plans to launch several new products in 2025, including an electric vehicle, to cater to the evolving needs of customers.

- Outlook: The company remains optimistic about the future and expects continued growth in the Indian automotive market.

These takeaways indicate the strong performance of Maruti Suzuki and its potential for future growth. Investors and analysts closely monitor the company's financial results to make informed investment decisions.

Maruti Suzuki Logo, symbol, meaning, history, PNG, brand - Source logos-world.net

Maruti Suzuki Q3 Results 2025: Key Takeaways For Investors And Analysts

Maruti Suzuki India Limited (MSIL), India's largest car manufacturer, reported its financial results for the third quarter (Q3) of the fiscal year 2024-25 (FY25) on January 20, 2025. The company's performance during the quarter was marked by strong demand for its vehicles, leading to robust sales and revenue growth. Here are some key takeaways from the Maruti Suzuki Q3 results for investors and analysts:

3 Key Takeaways Three Key Areas for Investors in Private Equity Funds - Source ktslaw.com

Strong Sales and Revenue Growth: Maruti Suzuki reported a strong performance in terms of sales and revenue during Q3 FY25. The company sold a total of 522,862 vehicles during the quarter, a growth of 12.6% compared to the same period last year. This growth was driven by increased demand for the company's popular models such as the Alto, Swift, and WagonR. The company's revenue for the quarter stood at Rs 29,988 crore, a growth of 15.2% year-over-year.

Improved Profitability: Maruti Suzuki's profitability also improved during Q3 FY25. The company's operating profit for the quarter stood at Rs 5,212 crore, a growth of 18.5% compared to the same period last year. The company's net profit for the quarter stood at Rs 3,894 crore, a growth of 21.4% year-over-year. The improved profitability was driven by higher sales volume, cost optimization efforts, and favorable foreign exchange movement.

Outlook for the Future: Maruti Suzuki's management expressed optimism about the future and expects the demand for its vehicles to remain strong in the coming quarters. The company plans to launch new models and variants in the future to cater to the evolving needs of customers. The company also expects to benefit from the government's focus on promoting electric vehicles in the country.

Key Takeaway for Investors: Maruti Suzuki's Q3 FY25 results indicate that the company is well-positioned to benefit from the growing demand for vehicles in India. The company's strong sales, revenue, and profitability growth are expected to continue in the coming quarters.

Related Posts