Seeking to open a window into the world of IPOs?

Editor's Notes: "IPOs: A Comprehensive Guide For Beginners" published today, is a must read that will help you navigate the intricacies and complexities of IPOs, empowering you to make the right decisions.

Our team has put in a great amount of effort into analyzing and understanding IPOs. This guide is the result of our thorough research, crafted to provide you with a comprehensive understanding of IPOs and will serve as a valuable resource on your journey toward making informed decisions about IPOs.

Benefits of Reading "IPOs: A Comprehensive Guide For Beginners":

| Without Guide | With Guide | |

|---|---|---|

| Understanding IPOs | Limited knowledge and understanding | In-depth understanding of IPOs |

| Decision Making | Based on limited information and analysis | Informed decisions based on comprehensive analysis and insights |

| Investment Strategy | Lack of a clear and effective investment strategy | Development of a tailored investment strategy for IPOs |

FAQ

This comprehensive guide provides answers to frequently asked questions (FAQs) about Initial Public Offerings (IPOs), empowering individuals with the necessary knowledge to navigate the complexities of this investment strategy.

5 rumoured IPOs for 2024 | Hargreaves Lansdown - Source www.hl.co.uk

Question 1: What is an IPO?

An IPO represents the first public offering of a company's shares on a stock exchange. This process enables private companies to access public capital markets, expand their operations, and provide liquidity to early investors.

Question 2: How does an IPO benefit companies?

Companies gain several advantages from an IPO, including access to significant capital, enhanced visibility, and increased credibility in the financial markets.

Question 3: What are the risks associated with IPOs?

IPOs carry inherent risks, such as share price volatility, potential for overpricing, and diminished control for founders. Investors should carefully consider these factors before participating in an IPO.

Question 4: How do I evaluate an IPO?

To assess an IPO, investors should analyze the company's financial health, industry outlook, management team, and competitive landscape.

Question 5: What are some common misconceptions about IPOs?

Some misconceptions include the belief that IPOs always provide instant profits, that they are suitable for all investors, and that they guarantee long-term success.

Question 6: Should I invest in IPOs?

The decision to invest in IPOs depends on an individual's investment objectives, risk tolerance, and financial situation. It is crucial to conduct thorough research and consult with financial professionals before making any investment decisions.

In summary, IPOs offer opportunities for investment and company growth, but they also involve risks. Understanding the complexities and carefully evaluating the options available is essential for informed decision-making.

Proceeding to the next section: Understanding the IPO Process

Tips

To succeed in the IPO market, it is essential to follow some key tips. These tips can help investors make informed decisions and maximize their returns.

Tip 1: Understand the IPO process.

Before investing in an IPO, it is important to understand the process involved. This includes the different stages of the IPO, the role of underwriters, and the potential risks involved.

10 Tips & Tricks To Get Started in Abiotic Factor: Beginners Guide - Source thenerdstash.com

Tip 2: Research the company.

It is crucial to research the company issuing the IPO. This includes its financial performance, its management team, and its competitive landscape.IPOs: A Comprehensive Guide For Beginners

Tip 3: Set realistic expectations.

IPOs can be volatile, and it is important to set realistic expectations about potential returns. Investors should not expect to make a quick fortune from an IPO.

Tip 4: Diversify your portfolio.

Investing in IPOs should be part of a diversified portfolio. This helps to reduce risk and increase the chances of long-term success.

Tip 5: Be patient.

IPOs can take time to mature. Investors should be patient and not expect to see immediate returns.

By following these tips, investors can increase their chances of success in the IPO market. However, it is important to remember that IPOs are not without risk. Investors should always do their own research and consult with a financial advisor before making any investment decisions.

These tips can help investors make informed decisions and maximize their returns. It is important to remember that IPOs are not without risk. Investors should always do their own research and consult with a financial advisor before making any investment decisions.

IPOs: A Comprehensive Guide For Beginners

In the realm of finance, IPOs (Initial Public Offerings) stand as pivotal events, bridging the gap between private and public markets. Understanding the intricacies of IPOs is paramount for both investors seeking to capitalize on new opportunities and companies embarking on a transformative phase of their growth journey.

B2B Marketing: A Comprehensive Guide to Success | Tangible - Source tangible.agency

- Purpose: Raising Capital

- Process: Transition from Private to Public

- Valuation: Determining the Company's Worth

- Benefits: Accessing Public Markets and Enhancing Credibility

- Risks: Market Volatility and Performance Pressure

- Types: Traditional, Direct Listing, and SPAC Merger

A Comprehensive Guide to Essential Car Rental App Features - Source arswebtech.com

These key aspects provide a comprehensive foundation for understanding IPOs. The purpose of an IPO is to raise capital, enabling companies to fund expansion, innovation, and debt reduction. The process involves transitioning from a privately held entity to a publicly traded company, subjecting the company to increased scrutiny and regulatory oversight. Valuation plays a crucial role, as it determines the price at which the company's shares are offered to the public. Benefits include accessing larger pools of investors, enhancing the company's credibility, and facilitating future capital raises. However, IPOs also come with risks, such as market volatility and the pressure to deliver strong financial performance. Finally, different types of IPOs exist, each with its own advantages and considerations.

IPOs: A Comprehensive Guide For Beginners

An initial public offering (IPO) is a significant event in the life of a company. It is the process by which a private company becomes a public company, and its shares are offered for sale to the public for the first time. IPOs can be a major source of capital for companies, and they can also provide investors with an opportunity to participate in the growth of promising businesses.

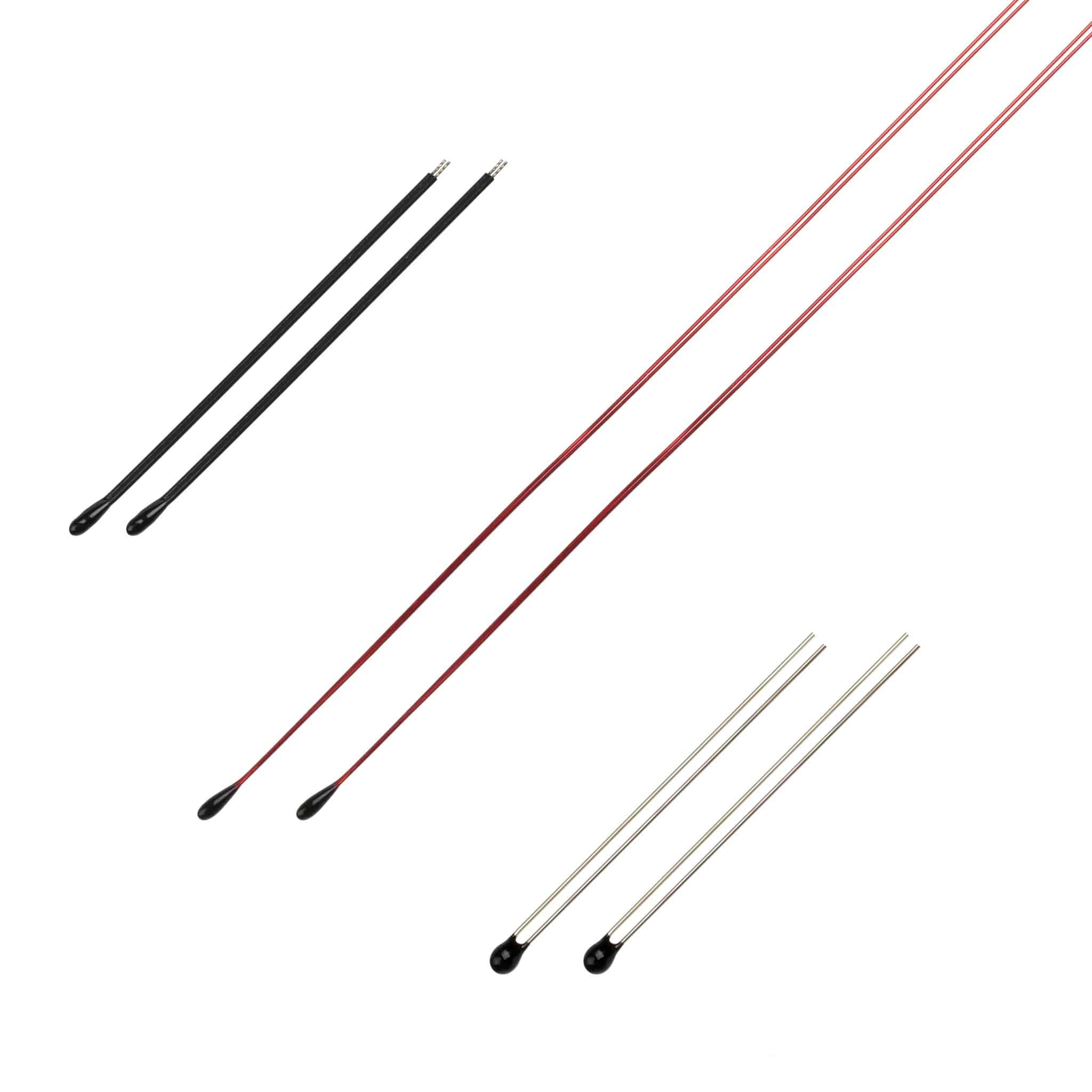

Comprehensive Guide: Using dht11 Temperature and Humidity Sensor with - Source www.starlightsensors.com

There are many reasons why a company might choose to go public. Some companies do so to raise capital for expansion, while others do so to increase their liquidity or to improve their access to the capital markets. IPOs can also be used to create a public market for a company's shares, which can make it easier for investors to buy and sell those shares.

The process of going public can be complex and time-consuming. It can take several months or even years to complete, and it can be expensive. However, the potential rewards of an IPO can be substantial. Companies that go public can gain access to a larger pool of capital, and they can also benefit from increased visibility and credibility.

If you are considering investing in an IPO, it is important to do your research. You should carefully review the company's financial statements and business plan, and you should consider the risks involved. IPOs can be volatile, and there is always the risk that a company will not meet its expectations.

Conclusion

IPOs can be a great way for companies to raise capital and grow their businesses. However, they can also be risky for investors. It is important to do your research and carefully consider the risks before investing in an IPO.

If you are considering investing in an IPO, you should consider the following factors:

- The company's financial statements and business plan

- The risks involved

- Your own investment goals and risk tolerance

Related Posts