After doing some analysis, digging information, made Everything You Need To Know About The ECB's Interest Rate Policy we put together this Everything You Need To Know About The ECB's Interest Rate Policy guide to help target audience make the right decision.

Predicted Interest Rates For 2025 - Ayaan Monroe - Source ayaanmonroe.pages.dev

FAQ

This FAQ section provides concise answers to frequently asked questions regarding the European Central Bank's (ECB) interest rate policy. These responses aim to clarify common concerns or misconceptions.

Ecb Interest Rate 2024 - Etta Olivia - Source tasiayrosanne.pages.dev

Question 1: What is the ECB's interest rate policy?

The ECB's interest rate policy aims to maintain price stability in the Eurozone. The policy entails setting key interest rates, such as the refinancing rate, which banks charge each other for short-term loans.

Question 2: Why does the ECB adjust interest rates?

The ECB adjusts interest rates to manage inflation or deflation. Raising interest rates helps curb inflation by discouraging borrowing and spending, while lowering rates stimulates economic activity by encouraging investment and consumption.

Question 3: What is the impact of interest rate changes on businesses and consumers?

Increased interest rates typically lead to higher borrowing costs for businesses and consumers, potentially slowing down investment and spending. Conversely, lower interest rates make borrowing more affordable, potentially boosting economic activity.

Question 4: How does the ECB decide on interest rate changes?

The ECB's Governing Council meets regularly to assess economic conditions and determine appropriate interest rate levels. They consider various factors, such as inflation data, economic growth projections, and financial market developments.

Question 5: What are the potential risks of interest rate changes?

Rapid or excessive interest rate changes can trigger economic instability. Raising rates too quickly could stifle economic growth, while lowering them too aggressively could lead to inflation.

Question 6: How does the ECB communicate its interest rate decisions?

The ECB typically announces interest rate decisions at press conferences and publishes a statement explaining the rationale behind the changes.

These FAQs provide a general overview of the ECB's interest rate policy. For more detailed and up-to-date information, consult the ECB's official website.

Next Article Section:

Tips

To explore more about the ECB's interest rate policy in depth, one can read the article Everything You Need To Know About The ECB's Interest Rate Policy.

Tip 1: Understand the ECB's primary mandate.

The ECB's primary mandate is to maintain price stability in the Eurozone, which means keeping inflation rates low and stable. This is achieved by setting interest rates at a level that discourages excessive spending and lending.

Tip 2: Follow the ECB's communication.

The ECB communicates its monetary policy intentions through regular press conferences and statements. By paying attention to these communication channels, you can understand the ECB's assessment of the economy and its plans for future interest rate changes.

Tip 3: Consider the impact of interest rates on different financial markets.

Interest rates affect various financial markets, including the bond market, stock market, and currency markets. Higher interest rates tend to lead to lower bond prices and higher stock prices, while they can also strengthen or weaken the Euro's exchange rate.

Tip 4: Stay informed about economic data.

The ECB's interest rate decisions are based on economic data, such as inflation rates, unemployment levels, and economic growth forecasts. Keeping an eye on these data can help you anticipate potential changes in monetary policy.

Tip 5: Consult with financial experts.

If you have a specific financial need or concern, consider consulting with a financial expert who can provide personalized advice based on your individual circumstances and the current interest rate environment.

These tips can help you navigate the complexities of the ECB's interest rate policy. By understanding the ECB's mandate, following its communication, considering market impacts, staying informed about economic data, and seeking professional guidance when necessary, you can make informed decisions that align with your financial goals.

Everything You Need To Know About The ECB's Interest Rate Policy

The European Central Bank (ECB) establishes interest rate policy to manage inflation and support economic growth within the eurozone. Here are six key aspects to consider:

- Key Rate: The ECB sets the main refinancing rate, influencing other interest rates in the eurozone.

- Inflation Target: The ECB aims to keep inflation below but close to 2%, ensuring price stability.

- Economic Growth: Interest rates can stimulate or curb economic activity, balancing inflation and growth objectives.

- Market Expectations: The ECB considers market expectations and forecasts when setting policy, ensuring stability and market confidence.

- Forward Guidance: The ECB provides forward guidance on its potential future actions, enhancing policy transparency.

- Independence: The ECB is politically independent, ensuring that monetary policy decisions are based solely on economic assessments.

These key aspects work together to shape the ECB's interest rate policy. By managing inflation, the ECB contributes to price stability and long-term economic growth in the eurozone. Additionally, forward guidance and policy transparency help businesses and consumers plan for the future, fostering stability and minimizing uncertainty.

Everything You Need To Know About The ECB's Interest Rate Policy

The European Central Bank (ECB) is responsible for setting interest rates in the eurozone. Interest rates are the cost of borrowing money, and they have a significant impact on the economy. Higher interest rates make it more expensive to borrow money, which can lead to slower economic growth. Lower interest rates make it cheaper to borrow money, which can lead to faster economic growth.

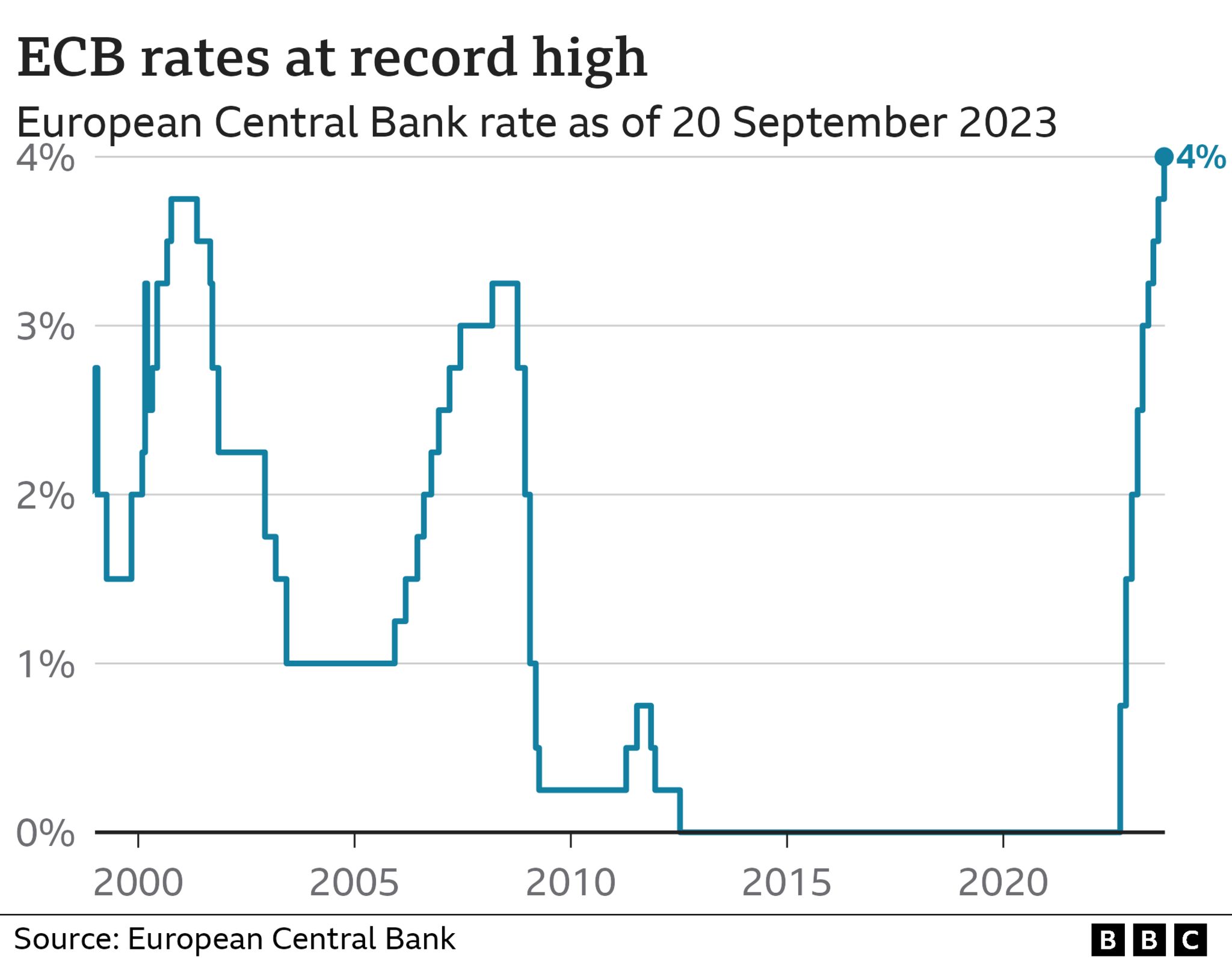

Negative interest rates: The ECB desperate - Source gefira.org

The ECB's interest rate policy is therefore a key tool for managing the eurozone economy. The ECB uses interest rates to try to achieve its main objective of price stability. The ECB's target for inflation is 2%. If inflation is too high, the ECB will raise interest rates to try to bring it back down to target. If inflation is too low, the ECB will lower interest rates to try to bring it back up to target.

The ECB's interest rate policy is also influenced by other factors, such as the economic outlook and the financial markets. The ECB will take all of these factors into account when setting interest rates.

The ECB's interest rate policy is a complex and important issue. It is essential for understanding how the eurozone economy works.

| Key Points | Explanation |

|---|---|

| The ECB's interest rate policy is a key tool for managing the eurozone economy. | Interest rates have a significant impact on economic growth and inflation. |

| The ECB's target for inflation is 2%. | The ECB will use interest rates to try to keep inflation at this target. |

| The ECB's interest rate policy is also influenced by other factors, such as the economic outlook and the financial markets. | The ECB will take all of these factors into account when setting interest rates. |

Conclusion

The ECB's interest rate policy is a complex and important issue. It is essential for understanding how the eurozone economy works.

The ECB's interest rate policy has a significant impact on the lives of everyone in the eurozone. It is important to understand how the ECB sets interest rates and how these rates affect the economy.

Related Posts